1. What is the projected Compound Annual Growth Rate (CAGR) of the Phenolic Resins for CCL?

The projected CAGR is approximately XX%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Phenolic Resins for CCL by Application (Rigid Copper Clad Laminate, Flexible Copper Clad Laminate), by Types (Powder, Flake), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

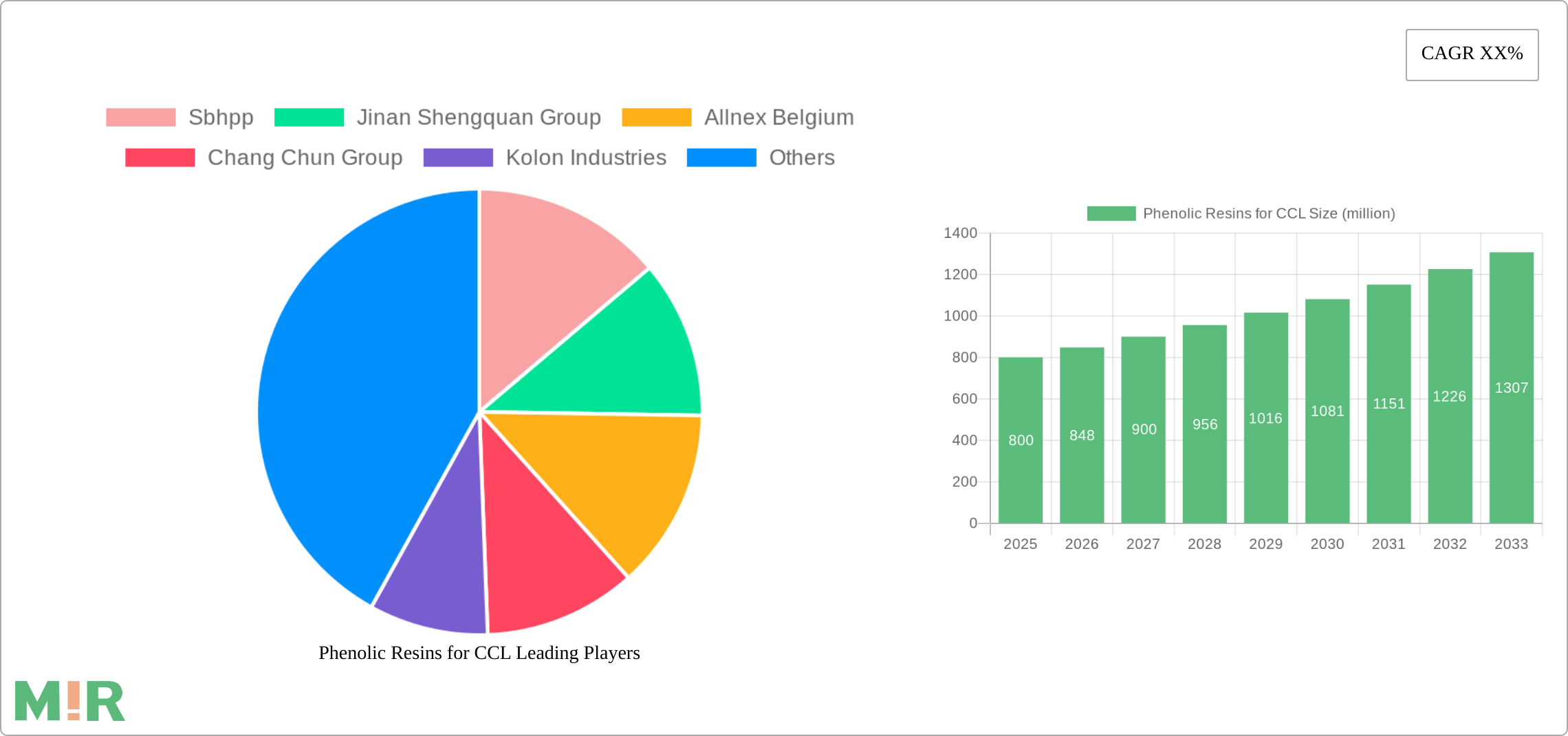

The global market for phenolic resins used in copper clad laminates (CCL) is experiencing robust growth, driven by the increasing demand for high-performance electronics and the automotive industry's shift towards electric vehicles. The market, estimated at $500 million in 2025, is projected to exhibit a compound annual growth rate (CAGR) of 6% from 2025 to 2033, reaching approximately $800 million by 2033. This expansion is fueled by several key factors. Firstly, the proliferation of smartphones, laptops, and other electronic devices necessitates high-quality CCLs with superior insulation and thermal properties, leading to increased phenolic resin demand. Secondly, the burgeoning electric vehicle (EV) market is a significant driver, as EVs require more advanced CCLs in their power electronics and battery management systems. The rigid copper clad laminate segment currently holds a larger market share compared to the flexible segment, reflecting the dominance of rigid PCBs in various applications. However, the flexible CCL segment is poised for faster growth due to the increasing adoption of flexible electronics in wearable technology and foldable devices. The powder form of phenolic resin currently dominates the market due to its ease of processing and cost-effectiveness, though flake resins are gaining traction for specific applications requiring enhanced performance characteristics. Geographic growth is expected across all regions, but Asia-Pacific, particularly China and India, will be key contributors due to their substantial electronics manufacturing industries. Challenges include fluctuations in raw material prices and environmental regulations surrounding resin production, potentially influencing pricing and production processes.

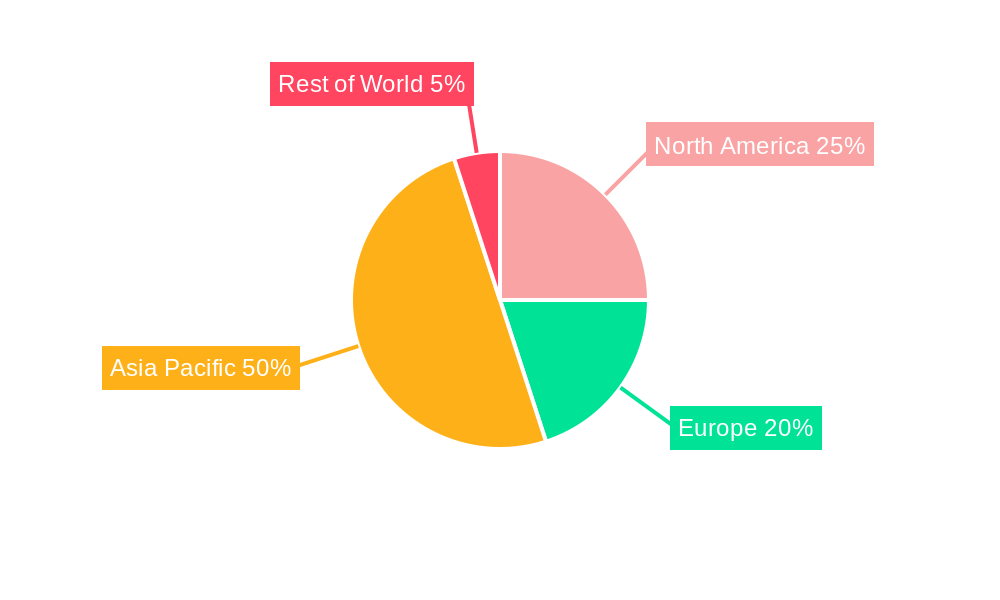

Growth within the phenolic resin market for CCLs is not uniform across all segments. While the overall market demonstrates a healthy CAGR, the specific growth rates for rigid versus flexible CCLs, and powder versus flake phenolic resins, will differ based on technological advancements and evolving application needs. Regional disparities also exist, reflecting variations in manufacturing capacity, consumer demand, and governmental regulations. North America and Europe are established markets with mature technological landscapes, while Asia-Pacific represents a high-growth region with significant potential. The competitive landscape is characterized by both large multinational corporations and regional players, resulting in intense competition and continuous innovation to secure market share. Successful players in this market will focus on providing customized solutions that meet evolving application requirements, while effectively managing raw material costs and navigating environmental compliance.

The global market for phenolic resins used in copper clad laminates (CCL) is estimated at $1.5 billion in 2023. Key players, including Sbhpp, Jinan Shengquan Group, Allnex Belgium, Chang Chun Group, Kolon Industries, Shandong Laiwu Runda, Kangnam Chemical, and Kuentek Cashew, control a significant portion of this market, with the top five companies holding approximately 70% market share.

Concentration Areas:

Characteristics of Innovation:

Impact of Regulations:

Stringent environmental regulations regarding VOC emissions are driving the adoption of low-VOC phenolic resins. Furthermore, regulations pertaining to the use of hazardous substances are impacting resin formulations and manufacturing processes.

Product Substitutes:

Epoxy resins and other thermosetting polymers present some level of competition, particularly in specialized high-performance applications. However, phenolic resins maintain a strong position due to their cost-effectiveness and suitable performance characteristics in many CCL applications.

End User Concentration:

The largest end-users are manufacturers of printed circuit boards (PCBs) for various electronics applications, including smartphones, computers, and automotive electronics. This concentration creates a high degree of interdependence and sensitivity to market fluctuations within the electronics sector.

Level of M&A:

The level of mergers and acquisitions (M&A) activity in the phenolic resin market for CCL is moderate. Strategic partnerships and collaborations are more frequent than outright acquisitions, aimed at expanding product portfolios and improving access to new markets.

The market for phenolic resins in CCL is experiencing several key trends that will shape its future. The rising demand for high-performance electronics, particularly in 5G and automotive applications, is a significant driver. These applications demand resins with improved thermal stability and dielectric properties, leading to innovation in resin formulations. The trend towards miniaturization and increased circuit density in electronics further fuels the demand for high-quality, precision-engineered resins. The growing preference for environmentally friendly manufacturing processes is also impacting the market. Manufacturers are increasingly focusing on reducing VOC emissions and developing sustainable resin formulations to meet stringent environmental regulations. This necessitates investment in R&D and adoption of more sustainable manufacturing techniques. Simultaneously, the industry is witnessing price fluctuations in raw materials, which influence the overall cost of phenolic resins and impact profitability. The cost of key raw materials such as phenol and formaldehyde, often fluctuates based on global supply and demand dynamics and geopolitical factors, prompting companies to adopt strategies to mitigate these impacts such as securing long-term supply contracts and exploring alternative raw material sources. Furthermore, the global economic outlook also plays a crucial role. Economic downturns typically reduce demand for electronics and consequently for CCLs, resulting in decreased demand for phenolic resins. Conversely, periods of economic growth lead to increased demand. Finally, competition from alternative materials such as epoxy resins and other thermosetting polymers continues, although phenolic resins maintain a strong market presence due to their cost-effectiveness and suitability for many applications. Companies are therefore exploring strategies to differentiate their products and improve their competitive position through innovation and the development of specialized resins catering to niche applications.

The Asia-Pacific region, particularly China, is currently dominating the phenolic resin market for CCL. This is attributable to the region's robust electronics manufacturing sector, which is a primary driver of demand for CCLs.

Asia-Pacific Dominance: This region accounts for over 60% of global demand, driven by the significant manufacturing presence in China, Japan, South Korea, and Taiwan. The burgeoning electronics industry in these countries fuels the demand for high-quality CCLs, resulting in high consumption of phenolic resins. The growing middle class in these economies, coupled with increasing smartphone and electronic device penetration, is further driving demand.

Rigid CCL: Rigid CCLs command a larger share of the market than flexible CCLs. This is attributed to the widespread use of rigid PCBs in various electronic devices, including computers, smartphones, and other electronic equipment. The market for rigid CCLs is expected to remain dominant due to its widespread application in high-volume, high-density PCBs.

Powder Phenolic Resins: Powder resins are favored due to their ease of handling, consistent quality, and effective incorporation into the CCL manufacturing process. This form also leads to less waste and improved efficiency in production compared to flake resins. The greater consistency and ease of handling result in less material loss and decreased production costs.

This report provides a comprehensive analysis of the phenolic resin market for CCLs, covering market size, growth trends, regional dynamics, key players, and future outlook. The report includes detailed market segmentation by resin type (powder, flake), CCL application (rigid, flexible), and geographic region. It also presents an in-depth analysis of competitive landscapes, including company profiles, market share data, and SWOT analyses. Furthermore, the report features insights into emerging trends, challenges, and opportunities in the market. The deliverables include an executive summary, market overview, market segmentation, competitive analysis, and a detailed forecast.

The global market for phenolic resins used in CCLs is experiencing steady growth, driven by the increasing demand for electronic devices and the expansion of the electronics industry. The market size in 2023 is estimated at $1.5 billion. The market is projected to reach $2 billion by 2028, exhibiting a compound annual growth rate (CAGR) of approximately 7%. This growth is fueled by the increasing demand for high-performance electronics, particularly in 5G and automotive applications. The market share is concentrated among a few major players, with the top five companies holding approximately 70% of the market. However, there is also considerable presence of smaller, regional players, catering to specific niche markets and regional demands. The competitive landscape is characterized by intense competition among these players, resulting in innovations in resin formulations, continuous improvement of manufacturing processes, and attempts to reduce costs. The market growth, however, is also influenced by various factors such as raw material price fluctuations, economic conditions, and environmental regulations. Understanding these dynamics is critical for effective strategic planning and market penetration. Growth segments such as high-performance electronics and environmentally friendly resins are expected to fuel the expansion of this market further in the coming years.

The increasing demand for electronic devices, particularly smartphones, computers, and automotive electronics, is a major driver of the market growth. This escalating demand directly translates to a higher need for printed circuit boards (PCBs), which in turn requires a greater quantity of phenolic resins. Furthermore, technological advancements in electronics, such as the development of 5G technology and electric vehicles, necessitate the use of high-performance phenolic resins with enhanced thermal stability and dielectric properties. This trend pushes manufacturers to constantly innovate in resin formulations to meet the stringent requirements of advanced electronics. Finally, the ongoing miniaturization of electronic components results in a need for resins that can maintain quality and performance in smaller and more intricate designs.

Fluctuations in raw material prices, particularly phenol and formaldehyde, represent a significant challenge. These price fluctuations directly influence the overall cost of phenolic resins, potentially impacting profitability and market competitiveness. Stringent environmental regulations related to VOC emissions also pose challenges, necessitating the development of environmentally friendly resin formulations and manufacturing processes. Increased compliance costs and the need for investment in new technologies add pressure on manufacturers. Competition from alternative materials such as epoxy resins also presents a challenge. Epoxy resins offer superior properties in specific applications, forcing phenolic resin producers to continuously innovate and offer competitive prices and specialized products.

The development of high-performance phenolic resins with enhanced thermal stability and dielectric properties for high-frequency applications is a key emerging trend. This trend is driven by the increasing demand for high-speed electronics. Another significant trend is the focus on developing environmentally friendly resins with reduced VOC emissions to meet stringent environmental regulations. This involves developing new formulations and exploring more sustainable manufacturing methods. Furthermore, research into novel resin formulations for enhanced mechanical strength and flexibility is gaining traction, particularly for flexible CCL applications. Cost-effective manufacturing processes are being explored to improve competitiveness and broaden market access.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Sbhpp, Jinan Shengquan Group, Allnex Belgium, Chang Chun Group, Kolon Industries, Shandong Laiwu Runda, Kangnam Chemical, Kuentek Cashew.

The market segments include Application, Types.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Phenolic Resins for CCL," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Phenolic Resins for CCL, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

See the similar reports

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.