1. What is the projected Compound Annual Growth Rate (CAGR) of the Single Phase PV Inverter Market?

The projected CAGR is approximately 5.5%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Single Phase PV Inverter Market by Connectivity (Standalone, On Grid), by Application (Residential, Commercial & Industrial), by North America (U.S., Canada), by Europe (Germany, Italy, Poland, Netherlands, Austria, UK, France), by Asia Pacific (China, Australia, India, Japan, South Korea), by Middle East & Africa (Israel, Saudi Arabia, UAE, South Africa), by Latin America (Brazil, Mexico, Chile) Forecast 2025-2033

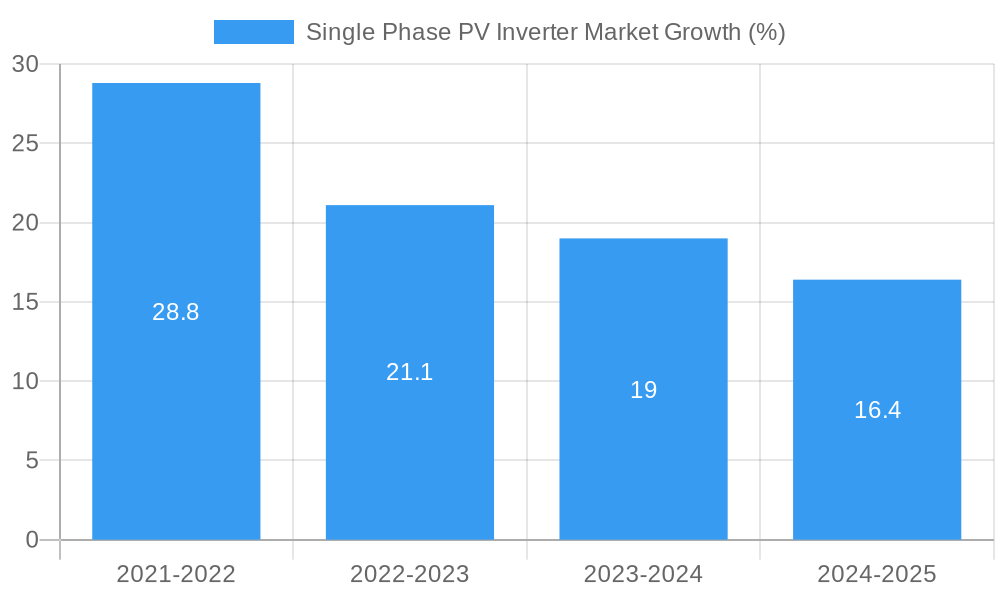

The size of the Single Phase PV Inverter Market was valued at USD 4.5 Billion in 2023 and is projected to reach USD 6.55 Billion by 2032, with an expected CAGR of 5.5% during the forecast period. This growth is influenced by the growing demand for renewable energy, technology advancements, government incentives, and increased awareness about energy consumption. Hybrid inverters have significantly contributed to market demand because they optimize energy production, store electricity, and provide backup power during grid outages. Supportive government policies such as net metering and rebates on the installation of solar panels have encouraged consumers to embrace single-phase PV inverters. They greatly contribute to the efficiency of energy usage and the development of clean energy sources. The trend for sustainable environments will, therefore, pick up on the adoption of single-phase PV inverters, amplifying the market size in the coming years.

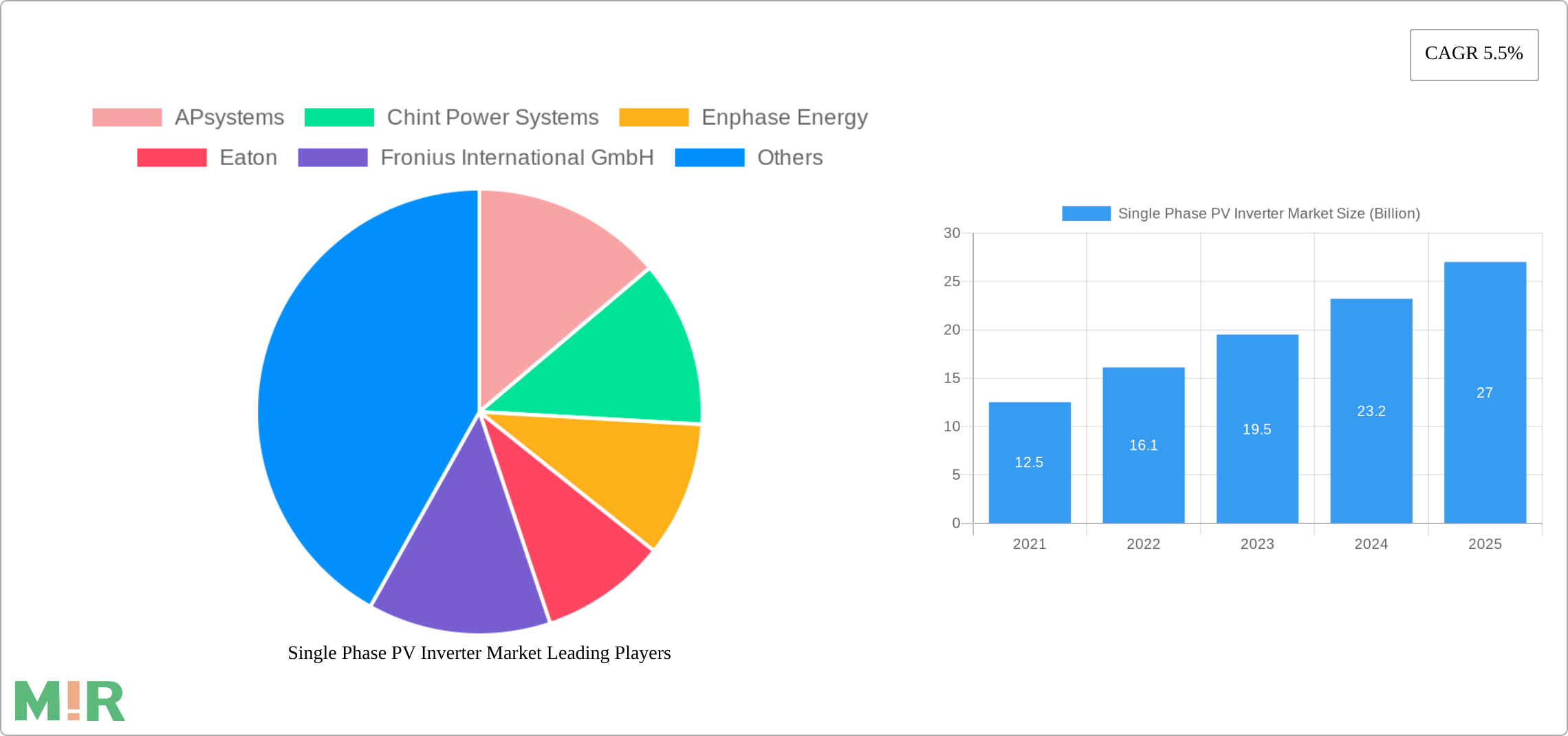

The single phase PV inverter market is moderately concentrated, with a few key players dominating the market share. Leading manufacturers include APsystems, Chint Power Systems, Enphase Energy, Eaton, Fronius International GmbH, GOODWE, Huawei Technologies Co., Ltd, INVTSolar, NingBo Deye Inverter Technology Co.Ltd, Solaredge Technologies, Inc, Statcon Energiaa, SUNGROW, UTL Solar, and Victron Energy B.V.

Innovation is a significant characteristic of the market, with companies investing in research and development to enhance product efficiency and reliability. Additionally, government regulations and standards play a crucial role in shaping product specifications and ensuring product safety.

The single-phase PV inverter market is experiencing dynamic growth, fueled by the increasing global adoption of renewable energy sources. Hybrid inverters remain a market leader, offering significant advantages such as seamless self-consumption of solar energy and reliable backup power during grid outages. This functionality is further enhanced by technological advancements, integrating Artificial Intelligence (AI) and the Internet of Things (IoT) for remote system monitoring, predictive maintenance, and performance optimization. This allows for proactive issue identification and resolution, maximizing system efficiency and lifespan.

A key trend is the increasing integration of energy storage systems (ESS) with single-phase PV inverters. This integration provides consumers with a comprehensive energy management solution, enabling the storage of excess solar energy for later use, reducing reliance on the grid and maximizing the utilization of clean energy. This capability is particularly attractive in areas with fluctuating electricity prices or unreliable grid infrastructure.

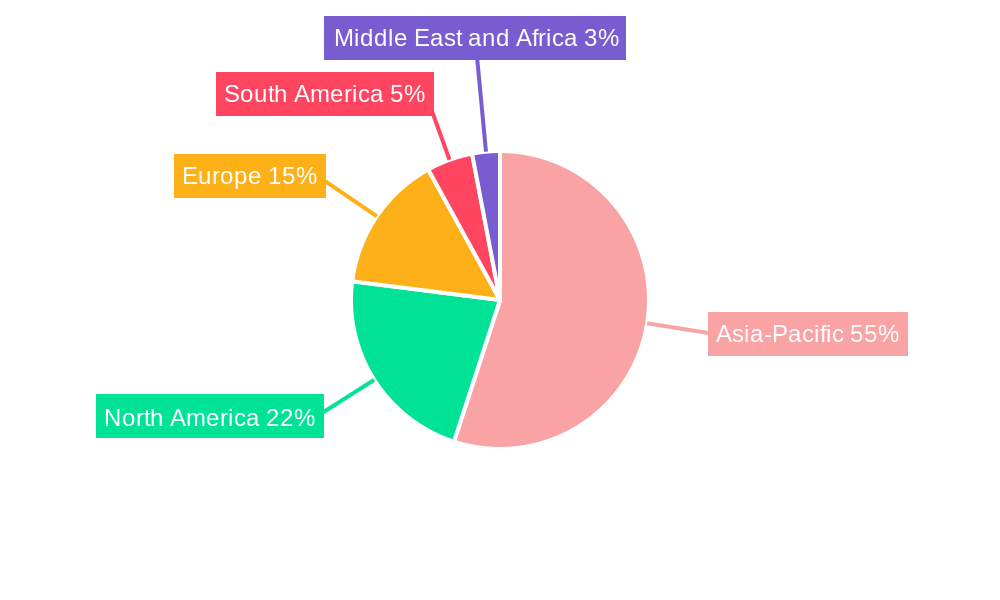

The Asia-Pacific region currently dominates the single-phase PV inverter market, with China, India, and Japan as key contributors. This dominance is driven by robust government support for renewable energy initiatives, expanding solar energy adoption, and a large consumer base. North America and Europe also represent significant markets, benefiting from supportive government policies, strong environmental consciousness, and a growing demand for sustainable energy solutions. Within these regions, the residential sector is experiencing the fastest growth, driven by homeowner interest in reducing energy bills and achieving greater energy independence. However, the commercial and industrial sectors are also demonstrating significant growth as businesses increasingly prioritize cost reduction and sustainability goals.

Single phase PV inverters are available in a range of power ratings, with common options including 3 kW, 4 kW, 5 kW, and 6 kW. These inverters typically feature maximum power point tracking (MPPT) technology to optimize energy production from solar panels.

Additional features, such as integrated Wi-Fi, monitoring capabilities, and compatibility with third-party energy storage systems, are becoming increasingly common. These features enhance the user experience and provide greater control over energy consumption.

Market Size: The single-phase PV inverter market is currently valued at $4.5 billion and is projected to reach $7.2 billion by 2027. This robust growth trajectory reflects the expanding global demand for solar energy solutions.

Market Share: The top five players currently hold approximately 50% of the market revenue share, indicating a competitive landscape with established and emerging players.

Growth: The market is expected to grow at a CAGR of 5.5% from 2022 to 2027, driven primarily by the increasing adoption of solar energy systems worldwide. This growth is expected to be sustained by ongoing technological advancements and supportive government policies.

North America: The U.S. is the largest market in North America, with a strong focus on residential and commercial solar installations.

Europe: Germany and Italy are significant markets, driven by government incentives and strong PV adoption rates.

Asia Pacific: China is the dominant market, accounting for over 50% of the region's revenue. India and Japan are also key contributors.

Middle East & Africa: The UAE and Saudi Arabia are emerging markets with growing demand for solar energy solutions.

Latin America: Brazil and Mexico are the leading markets, with growing investments in solar power generation.

May 2024: Statcon Energiaa launched the Energiaa-X Series of 3 kW and 5 kW single-phase solar inverters featuring built-in MPPT technology for enhanced efficiency.

October 2023: Sungrow introduced its high-powered SH8.0RS and SH10RS single-phase hybrid inverters designed for residential applications. These inverters offer multi-layer protection and compatibility with large-capacity batteries.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.5% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.5%.

Key companies in the market include APsystems, Chint Power Systems, Enphase Energy, Eaton, Fronius International GmbH, GOODWE, Huawei Technologies Co., Ltd, INVTSolar, NingBo Deye Inverter Technology Co.Ltd, Solaredge Technologies, Inc, Statcon Energiaa, SUNGROW, UTL Solar, Victron Energy B.V..

The market segments include Connectivity, Application.

The market size is estimated to be USD 4.5 Billion as of 2022.

Rising demand for renewable energy. Increasing technological advancements. Growing energy independence and sustainability.

Hybrid inverters continue to dominate the market. offering advantages such as self-consumption and backup during power outages. Technological advancements. including artificial intelligence and the Internet of Things (IoT). are enabling inverters to monitor and optimize system performance remotely. The integration of energy storage systems with single phase PV inverters is another emerging trend. providing consumers with a comprehensive energy management solution. This integration allows excess solar energy to be stored for use when needed. reducing reliance on the grid..

High initial costs.

In May 2024, Statcon Energiaa unveiled the single-phase Energiaa-X Series of solar inverters in 3 kW and 5 kW power ratings. These inverters hold additional features of built-in maximum power point tracking technology. The lower voltage inverter is ideal for residences, gyms, small offices, small clinics and shops. The product launch aims to expand the company portfolio across residential applications, targeting a wider range of customers.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4,850, USD 5,350, and USD 8,350 respectively.

The market size is provided in terms of value, measured in Billion and volume, measured in Gigawatts .

Yes, the market keyword associated with the report is "Single Phase PV Inverter Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Single Phase PV Inverter Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

See the similar reports

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.