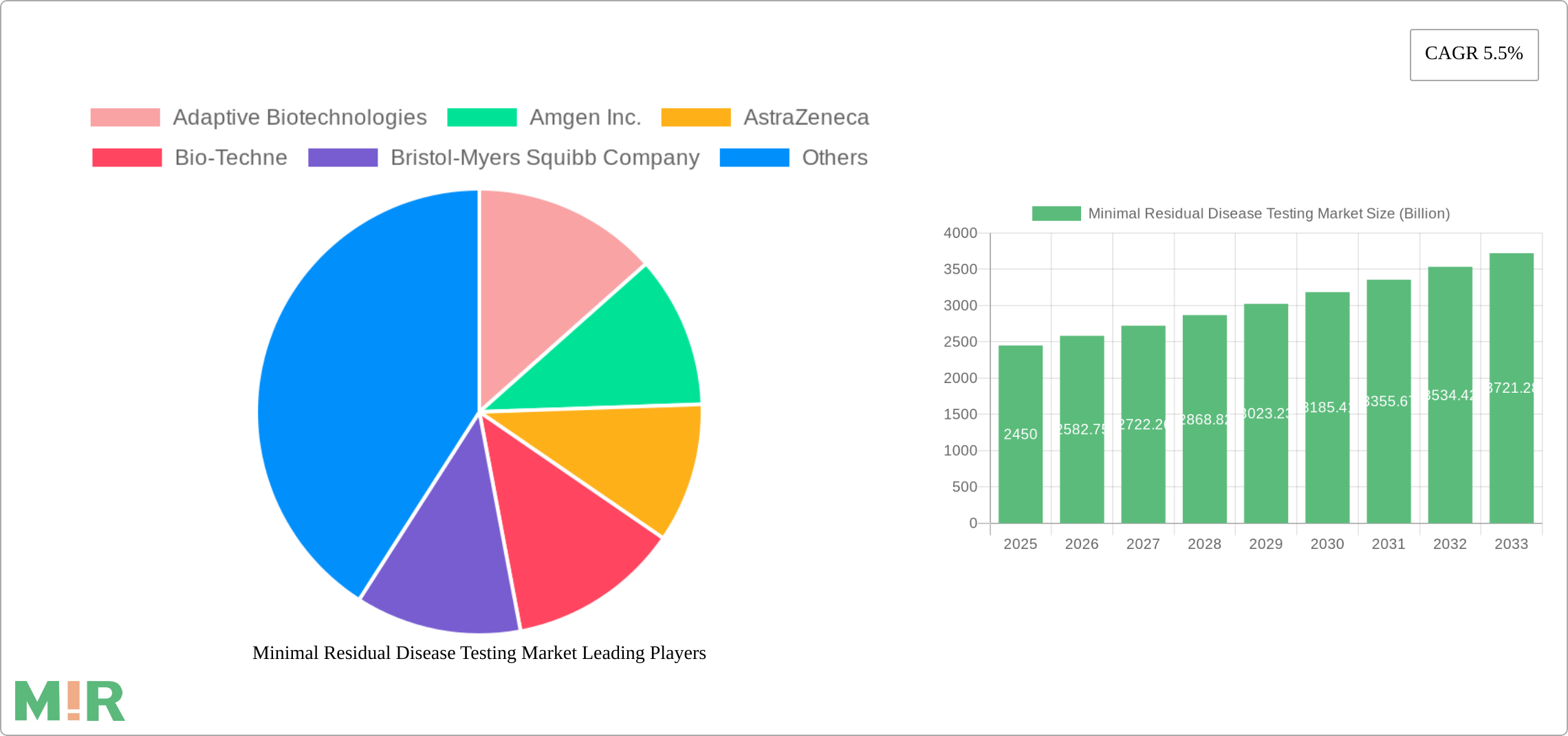

1. What is the projected Compound Annual Growth Rate (CAGR) of the Minimal Residual Disease Testing Market?

The projected CAGR is approximately 5.5%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Minimal Residual Disease Testing Market by Technology, 2018 - 2032 (USD Million & Units) (Flow-cytometry, Polymerase Chain Reaction (PCR), Next Generation Sequencing (NGS), Others), by Application, 2018 - 2032 (USD Million) (Lymphoma, Leukemia, Solid Tumors, Others), by End-use, 2018 - 2032 (USD Million) (Hospitals, Specialty Clinics, Diagnostic Centers, Others), by North America (U.S., Canada), by Europe (Germany, UK, France, Spain, Italy, Poland, Sweden), by The Netherlands (Asia Pacific, Japan, China, India, Australia), by South Korea (Thailand, Indonesia, Philippines), by Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru), by Middle East & Africa (South Africa, Saudi Arabia, UAE, Israel, Turkey, Iran) Forecast 2025-2033

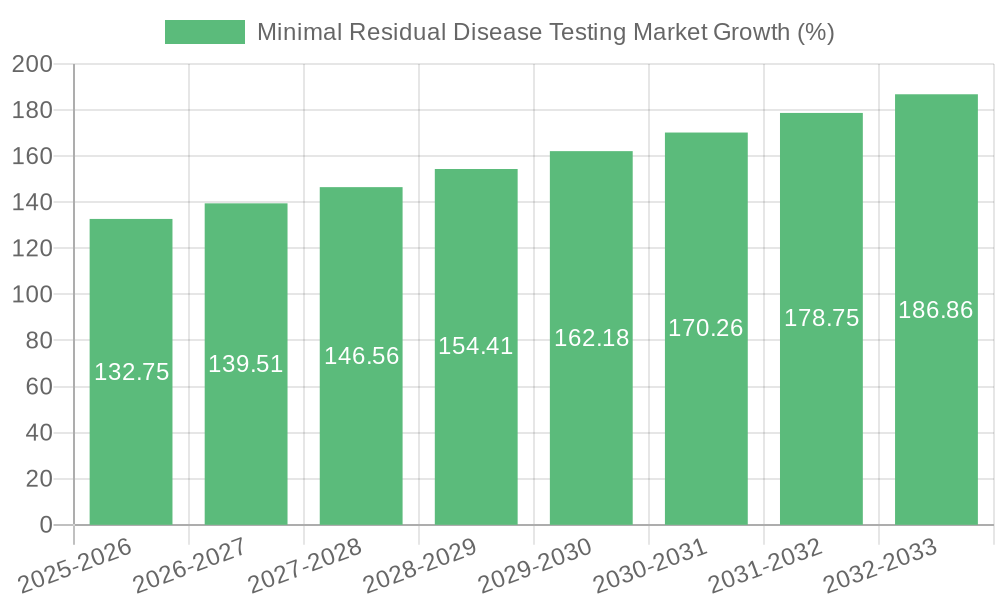

The Minimal Residual Disease (MRD) testing market is experiencing robust growth, projected to reach $2.45 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.5% from 2025 to 2033. This expansion is driven by several key factors. Advancements in technologies like flow cytometry, polymerase chain reaction (PCR), and next-generation sequencing (NGS) are enabling more sensitive and accurate MRD detection, leading to improved treatment strategies and patient outcomes. The increasing prevalence of hematological malignancies such as lymphoma and leukemia, along with a rising understanding of MRD's role in predicting relapse and guiding treatment decisions, are further fueling market growth. The shift towards personalized medicine and the adoption of MRD testing in clinical practice across various healthcare settings, including hospitals, specialty clinics, and diagnostic centers, are also contributing to this upward trajectory. While the market faces certain restraints, such as high testing costs and the need for skilled personnel to interpret results, the overall market outlook remains positive. The increasing availability of reimbursement options and continued technological innovation are likely to mitigate these challenges in the coming years.

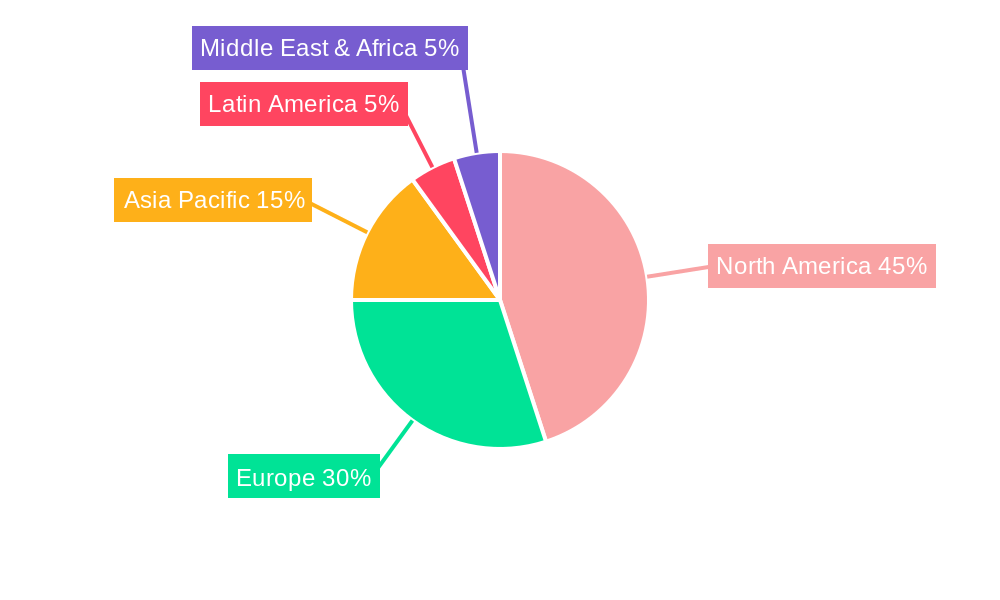

The geographic distribution of the MRD testing market reflects a strong presence in North America and Europe, driven by higher healthcare expenditure and advanced healthcare infrastructure. However, emerging economies in Asia-Pacific and Latin America are expected to showcase significant growth potential due to rising healthcare awareness, increasing prevalence of cancers, and improving healthcare access. The competitive landscape features a mix of established pharmaceutical companies like Amgen Inc., AstraZeneca, and Bristol-Myers Squibb Company alongside specialized biotechnology companies such as Adaptive Biotechnologies and Exact Sciences Corporation. These companies are actively involved in developing novel MRD testing technologies and expanding their market reach through strategic partnerships and acquisitions, further intensifying competition and driving innovation within the sector. The market segmentation by application (lymphoma, leukemia, solid tumors), technology (flow cytometry, PCR, NGS), and end-use (hospitals, clinics, diagnostic centers) offers valuable insights for market participants and strategic investors.

The Minimal Residual Disease (MRD) testing market is characterized by a moderately concentrated landscape, with a few key players holding significant market share. However, the market is experiencing substantial growth and increasing competition, particularly with the rise of innovative technologies.

Concentration Areas: The market is concentrated around companies with strong R&D capabilities and established distribution networks, primarily in North America and Europe. These companies often have a diverse product portfolio encompassing various MRD testing technologies.

Characteristics of Innovation: Innovation is driven by the development of more sensitive and specific assays, particularly in next-generation sequencing (NGS) and liquid biopsy technologies. Miniaturization of devices, improved sample preparation methods, and the integration of artificial intelligence (AI) for data analysis are also key areas of innovation.

Impact of Regulations: Regulatory approvals (FDA, EMA, etc.) significantly impact market entry and growth. Stringent regulatory requirements for diagnostic tests lead to a longer development cycle and increased costs for companies, but also ensure high quality and reliability.

Product Substitutes: While there aren’t direct substitutes for MRD testing, the availability of alternative diagnostic methods (e.g., imaging techniques) for monitoring disease progression can influence market penetration.

End User Concentration: The market is concentrated among hospitals, specialized oncology clinics, and diagnostic laboratories. These institutions possess the necessary infrastructure and expertise for complex MRD testing.

Level of M&A: The MRD testing market has seen a moderate level of mergers and acquisitions (M&A) activity, with larger players acquiring smaller companies with innovative technologies or expanding market access. We estimate the value of M&A activities in this space to have exceeded $2 Billion in the last 5 years.

The MRD testing market is experiencing rapid growth, fueled by several key trends. The increasing prevalence of cancers, particularly hematological malignancies, is a primary driver. Advances in technology are leading to more sensitive and specific tests, enabling earlier detection of residual disease and improved patient management. Furthermore, the shift towards personalized medicine is creating a higher demand for tailored diagnostic tools like MRD testing.

The rising adoption of NGS-based MRD assays is transforming the market. NGS offers higher sensitivity and the ability to detect a broader range of mutations, improving the accuracy of residual disease detection. The development of liquid biopsy techniques, allowing for minimally invasive sample collection (blood), is also a significant trend, increasing patient convenience and compliance.

Data analytics and AI are increasingly being integrated into MRD testing workflows to improve data interpretation and accelerate result reporting. This trend is improving the efficiency and effectiveness of MRD testing. Moreover, the development of standardized testing protocols and guidelines is enhancing the comparability and reliability of MRD testing results across different laboratories and settings.

The growing focus on early disease detection and minimal residual disease monitoring is driving increased investment in research and development. This includes exploring new biomarkers and developing more sophisticated algorithms for improved diagnostic accuracy. The market is also witnessing expansion into new cancer types, broadening the application of MRD testing beyond hematological malignancies. Finally, the integration of MRD testing into treatment decision-making is strengthening its role in improving patient outcomes. This is particularly relevant for tailoring treatment strategies and assessing response to therapy. We project the market to reach $8 Billion by 2032.

Technology Segment Dominance: Next-Generation Sequencing (NGS) is projected to dominate the MRD testing technology segment.

Reasons for NGS Dominance:

Regional Dominance: North America, specifically the United States, is expected to dominate the MRD testing market due to the high prevalence of cancer, robust healthcare infrastructure, and significant investment in research and development. Europe is also a major market, with Germany and the UK leading the way due to advanced healthcare systems and substantial government funding for healthcare innovation.

Application Segment: Lymphoma and Leukemia currently dominate the application segment, reflecting the established use of MRD testing in these cancer types. However, growth in solid tumor applications is expected to increase significantly.

End-Use Segment: Hospitals and specialized oncology clinics are the primary end-users due to their established infrastructure and experienced medical staff.

This report provides comprehensive insights into the Minimal Residual Disease Testing market, encompassing market sizing, segmentation analysis, competitive landscape, technology advancements, regulatory factors, and key trends. It includes detailed regional breakdowns and forecasts to 2032. The report also analyzes key industry players, assessing their strategies, product portfolios, and market positions. Finally, it offers actionable recommendations for stakeholders involved in the MRD testing market.

The global minimal residual disease (MRD) testing market is experiencing substantial growth driven by increasing cancer prevalence, technological advancements, and the growing adoption of personalized medicine. Market size is projected to reach approximately $7 Billion by 2028, demonstrating a robust Compound Annual Growth Rate (CAGR). This growth is fueled by several factors, including: increased sensitivity and specificity of tests (particularly NGS), the rise of liquid biopsies, and expansion into various cancer types (beyond hematological malignancies).

The market share distribution is dynamic, with key players competing based on technological innovation, regulatory approvals, and market access. Larger companies are investing heavily in R&D to develop cutting-edge assays, while smaller companies are focusing on niche applications and specific technologies. The market is witnessing a shift towards more comprehensive and integrated solutions that combine different technologies and bioinformatics tools. Competitive advantages lie in speed and accuracy of results, patient-friendly sample collection, and integration with existing healthcare workflows. The high cost of tests remains a challenge, but this is partly offset by the potential for significant cost savings in the long run through improved treatment efficacy. The market is expected to further consolidate through mergers and acquisitions as major players seek to expand their market share and product portfolios.

The MRD testing market is driven by several key factors: increasing cancer prevalence, technological advancements leading to more sensitive and specific tests, rising adoption of personalized medicine, growing demand for early disease detection and improved patient outcomes, and favorable regulatory support.

Challenges include the high cost of testing, the need for specialized expertise, and the complexity of assay interpretation. Regulatory hurdles and the lack of standardized protocols in certain regions also pose obstacles. Furthermore, reimbursement policies can influence market access and adoption rates.

Emerging trends include the increasing adoption of liquid biopsy techniques, integration of AI and machine learning for data analysis, development of novel biomarkers, and expansion into new cancer types and applications such as early detection.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.5% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately 5.5%.

Key companies in the market include Adaptive Biotechnologies, Amgen Inc., AstraZeneca, Bio-Techne, Bristol-Myers Squibb Company, Exact Sciences Corporation.

The market segments include Technology, 2018 - 2032 (USD Million & Units), Application, 2018 - 2032 (USD Million), End-use, 2018 - 2032 (USD Million).

The market size is estimated to be USD 2.45 Billion as of 2022.

Increasing prevalence of cancer. Technological advancements. Rising investment in R&D activities. Diagnostic advantages in minimal residual disease testing.

N/A

Stringent regulatory policies. High cost of minimal residual disease testing.

In December 2022, Adaptive Biotechnologies announced the launch of clonoSEQ to assess minimal residual disease (MRD) in patients with diffuse large b-cell lymphoma (DLBCL) using circulating tumor DNA (ctDNA). This strategic move assisted the company in bolstering its product portfolio and offered a competitive edge.

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4,850, USD 5,350, and USD 8,350 respectively.

The market size is provided in terms of value, measured in Billion.

Yes, the market keyword associated with the report is "Minimal Residual Disease Testing Market," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Minimal Residual Disease Testing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.