1. What is the projected Compound Annual Growth Rate (CAGR) of the Laser Cladding Services?

The projected CAGR is approximately XX%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Laser Cladding Services by Application (Optical Industry, Aerospace, Automotive, Others), by Types (Metal-Based Laser Cladding, Ceramic-Based Laser Cladding, Composite Material Laser Cladding, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The Laser Cladding Services market is experiencing robust growth, driven by increasing demand across diverse sectors like automotive, aerospace, and the optical industry. The rising need for enhanced surface properties in components, such as improved wear resistance, corrosion resistance, and thermal performance, fuels this market expansion. Advancements in laser technology, coupled with the development of new cladding materials (metal-based, ceramic-based, and composite materials), are further propelling market growth. The market is segmented by application (optical, aerospace, automotive, and others) and by type of cladding material used. While precise market sizing data is not provided, a logical estimation based on industry trends and average CAGRs for similar advanced manufacturing processes suggests a 2025 market size of approximately $500 million, with a projected CAGR of 7-8% from 2025-2033. This growth trajectory is expected to continue, primarily due to the adoption of laser cladding in high-value manufacturing applications requiring precision and efficiency. The increasing adoption of automation and Industry 4.0 technologies within manufacturing processes are also significant growth drivers.

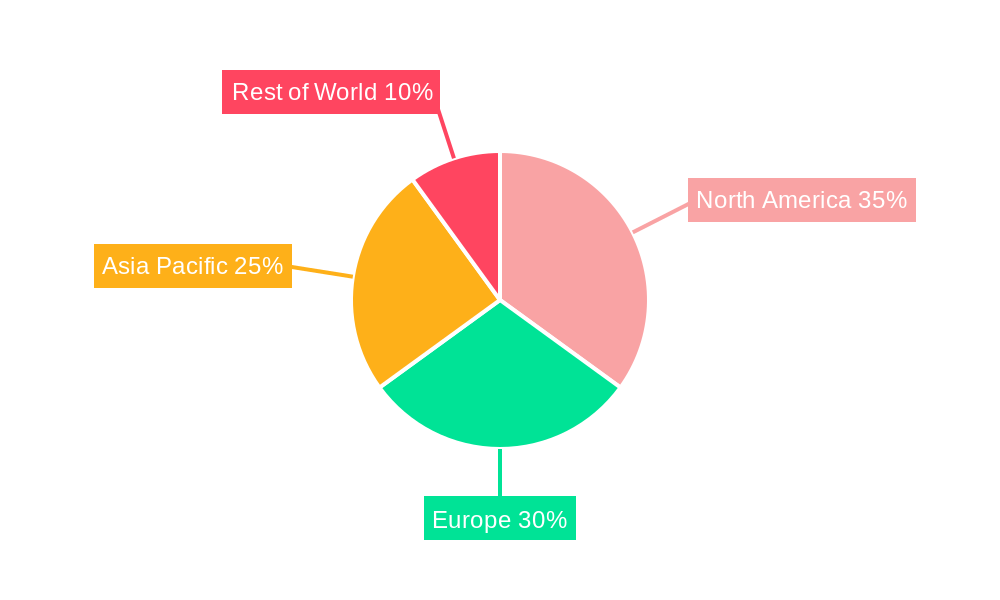

However, the market faces some restraints. The high initial investment costs associated with laser cladding equipment can be a barrier to entry for smaller companies. Furthermore, the need for skilled operators and specialized training limits market expansion in some regions. Despite these limitations, the significant advantages offered by laser cladding, including superior material properties and reduced processing time compared to traditional methods, are expected to drive sustained growth in the coming years. Geographic growth will likely be strongest in regions with established manufacturing bases and a focus on advanced manufacturing techniques, such as North America and Europe, followed by a rapid increase in the Asia-Pacific region driven by manufacturing expansion in China and India. Competition amongst established players and new entrants will remain fierce, driving innovation and cost optimization within the sector.

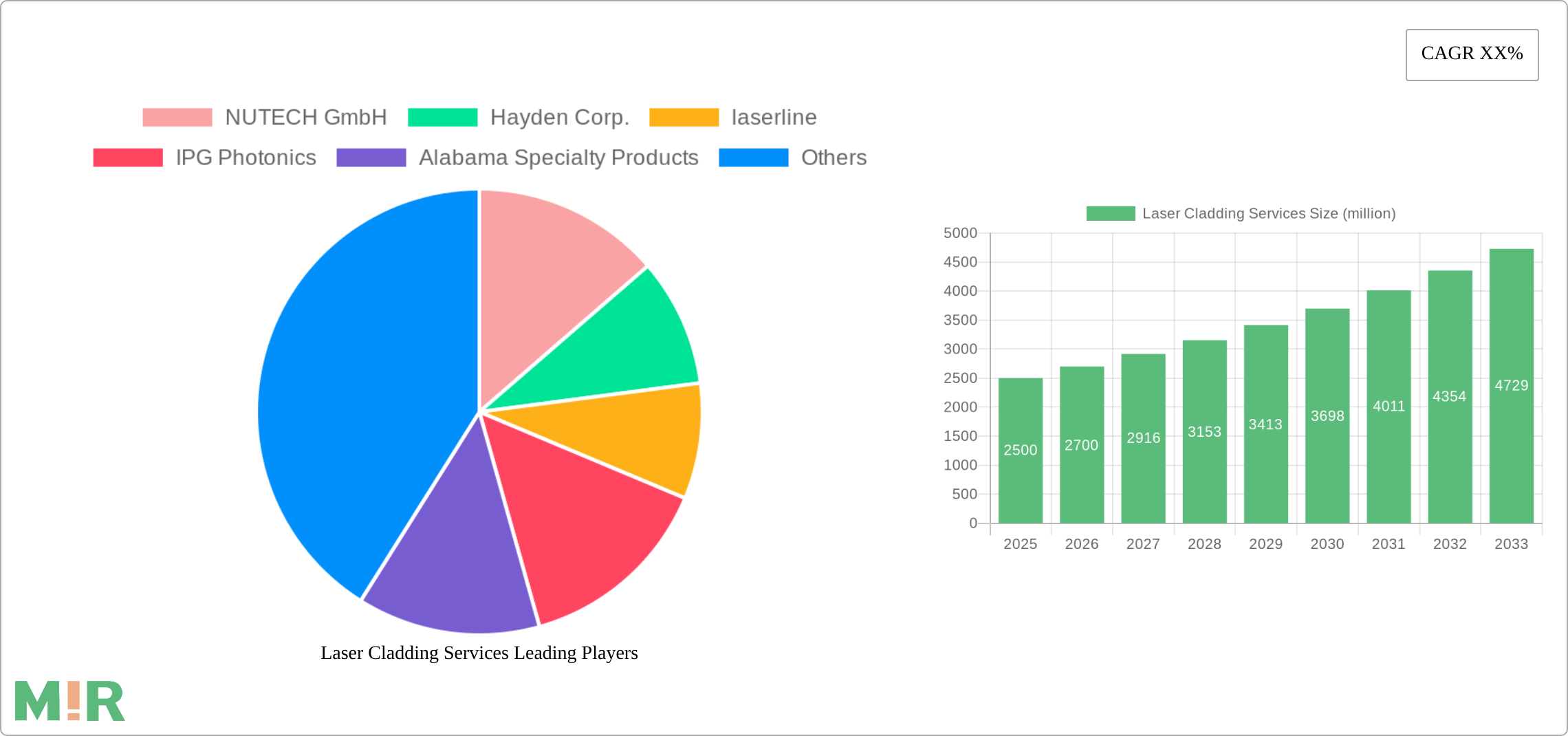

The laser cladding services market is estimated at $2.5 billion in 2024, exhibiting a moderately fragmented structure. Key players like IPG Photonics and NUTECH GmbH hold significant market share, but numerous smaller specialized firms also contribute substantially. Innovation is concentrated in areas such as improved laser sources (e.g., fiber lasers offering higher power and efficiency), advanced powder delivery systems for better control over the cladding process, and the development of new cladding materials with enhanced properties (high temperature resistance, wear resistance, corrosion resistance).

The laser cladding services market is experiencing significant growth driven by several key trends. The increasing demand for high-performance components in industries such as aerospace and automotive is a major driver. Manufacturers are constantly seeking ways to improve the durability, wear resistance, and corrosion resistance of their products, and laser cladding offers a precise and efficient solution for achieving these goals. The adoption of additive manufacturing (AM) techniques is also fueling market expansion, as laser cladding is increasingly integrated into AM workflows for creating complex components. The trend toward automation and digitization within manufacturing processes is leading to higher adoption of automated laser cladding systems, which offer increased efficiency and improved quality control. Furthermore, the development of new laser sources, such as high-power fiber lasers, and advancements in powder delivery systems are further enhancing the capabilities and efficiency of laser cladding. The growing demand for customized solutions in various industries, such as the medical and energy sectors, is also driving market growth, as laser cladding allows for the precise application of coatings to meet specific requirements. The increasing focus on sustainability and reduced waste is another key trend, as laser cladding offers a more environmentally friendly alternative to traditional coating methods. Finally, the ongoing research and development efforts in the field are leading to the development of innovative cladding materials and processes, which further expands the applications and possibilities of laser cladding. These combined trends contribute to the ongoing growth and evolution of this market.

The aerospace segment is projected to dominate the laser cladding services market due to the critical need for high-performance, lightweight, and corrosion-resistant components in aircraft and spacecraft manufacturing. North America, particularly the United States, is expected to hold a significant market share due to its advanced aerospace and automotive industries.

Dominant Segment: Aerospace. The stringent requirements for durability and reliability in aerospace applications make laser cladding an ideal solution for surface modification and component repair. This sector's focus on reducing weight while enhancing performance further drives adoption. Metal-based laser cladding dominates within the aerospace segment, owing to the prevalence of metal alloys in aircraft structures.

Dominant Region: North America (especially the United States). The strong presence of major aerospace manufacturers and a robust R&D ecosystem in the US make it the leading region for laser cladding services adoption in the aerospace sector.

Supporting Points:

This report provides a comprehensive analysis of the laser cladding services market, encompassing market size, segmentation, key players, and future growth projections. It includes detailed insights into market trends, driving forces, challenges, and emerging technologies. The deliverables include market size and forecast data, competitive landscape analysis, regional market analysis, and product and application segmentation analysis. Finally, the report offers valuable strategic recommendations for stakeholders interested in this market.

The global laser cladding services market is estimated to be valued at $2.5 billion in 2024, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 7% from 2024 to 2030. This growth is driven by factors such as the increasing demand for high-performance components in various industries, advancements in laser technology and materials science, and the growing adoption of additive manufacturing. Market share is distributed among several key players and numerous smaller specialized firms. IPG Photonics and NUTECH GmbH are estimated to hold a significant portion of the market share, with a combined market share approaching 25%. However, a larger portion of the market is shared among numerous smaller companies. The market growth is expected to be driven by the increasing adoption of laser cladding in high-growth sectors such as aerospace and automotive, as well as advancements in laser technology. The market is expected to witness steady growth driven by increased demand from various end-use sectors and technological improvements.

The laser cladding services market is propelled by several factors: the increasing demand for high-performance components in industries like aerospace and automotive, advancements in laser technology leading to increased efficiency and precision, the growing adoption of additive manufacturing techniques, and the development of new, high-performance cladding materials. Furthermore, the rising need for cost-effective surface modification techniques compared to traditional methods is driving adoption.

Challenges include the high initial investment cost for equipment, the need for skilled operators, and potential limitations in terms of the range of materials that can be effectively cladded. The complexity of the process and the need for precise control can also pose challenges. Furthermore, competition from alternative surface modification techniques can affect market growth.

Emerging trends include the integration of laser cladding with additive manufacturing, the development of hybrid laser cladding processes, the use of AI and machine learning for process optimization, and the growing focus on sustainable and environmentally friendly processes. There's also a trend towards more automated and robotic systems for enhanced efficiency.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include NUTECH GmbH, Hayden Corp., laserline, IPG Photonics, Alabama Specialty Products, Laser Cladding Corp., Xometry, APEX Engineering Technology Group, Titanova, Inc., Phoenix Laser Solutions, Swanson Industries, Spider Company, Arc Spray Engineering.

The market segments include Application, Types.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

The market size is provided in terms of value, measured in million.

Yes, the market keyword associated with the report is "Laser Cladding Services," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Laser Cladding Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

See the similar reports

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.