1. What is the projected Compound Annual Growth Rate (CAGR) of the L-Glutamic Acid Dimethyl Ester Hydrochloride?

The projected CAGR is approximately XX%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

L-Glutamic Acid Dimethyl Ester Hydrochloride by Application (Pharmaceutical Intermediate, Scientific Research), by Types (Purity≥98%, Purity≥99%), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

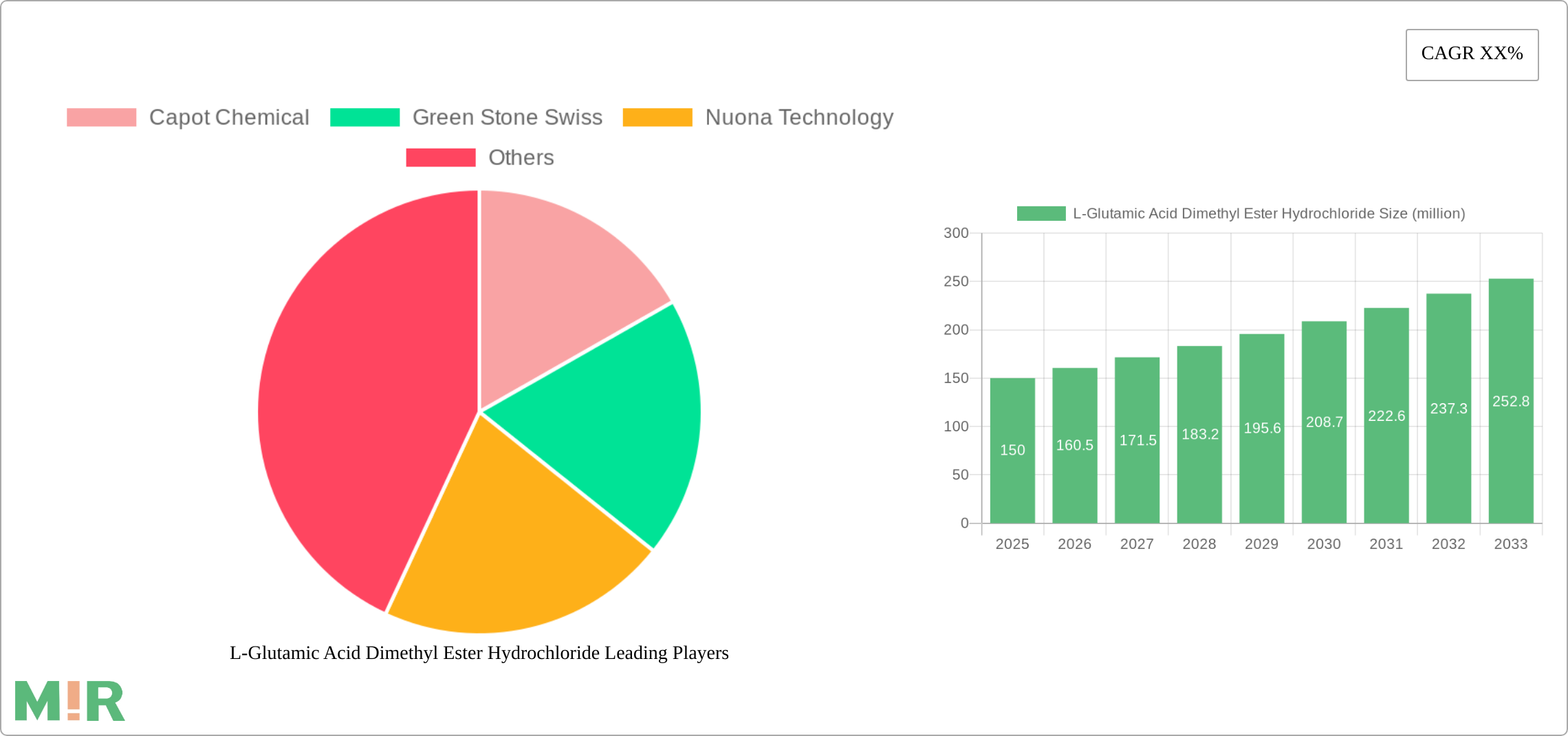

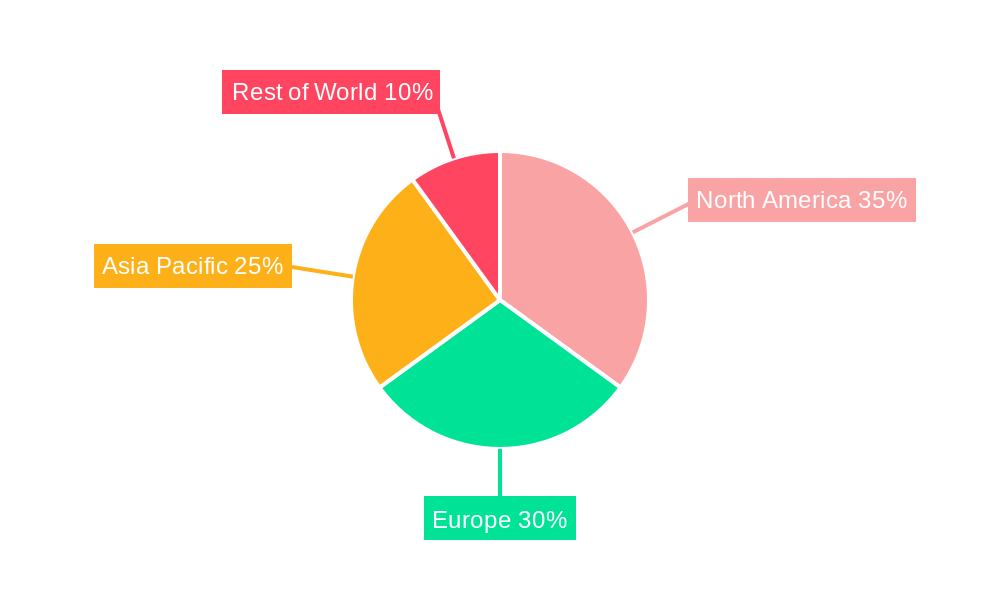

The L-Glutamic Acid Dimethyl Ester Hydrochloride market is experiencing robust growth, driven by increasing demand from the pharmaceutical and scientific research sectors. The market's expansion is fueled by the compound's versatility as a pharmaceutical intermediate in the synthesis of various drugs and its crucial role in various scientific research applications. The high-purity segments (Purity ≥98% and Purity ≥99%) are expected to dominate the market due to stringent quality requirements in these applications. While precise market sizing data is unavailable, considering similar specialty chemical markets with comparable CAGRs and growth drivers, a reasonable estimate for the 2025 market size would be around $150 million. Assuming a conservative CAGR of 7% (a figure reflective of growth in related specialty chemical markets), the market is projected to reach approximately $250 million by 2033. Key players like Capot Chemical, Green Stone Swiss, and Nuona Technology are shaping the market landscape through innovation and strategic expansion. Geographical distribution is likely skewed towards North America and Europe initially due to established research infrastructure and pharmaceutical industries, but Asia-Pacific, particularly China and India, is anticipated to experience significant growth in the forecast period, driven by expanding research capabilities and pharmaceutical manufacturing. Market restraints may include price volatility of raw materials and regulatory hurdles in specific regions.

The pharmaceutical intermediate application segment is likely to be the larger of the two application segments due to the higher volume requirements of pharmaceutical manufacturing. The higher purity grades command premium pricing due to the increased production costs and stringent quality control measures necessary. This leads to a premium price point for these higher purity grades. The market's growth trajectory is expected to remain strong throughout the forecast period, supported by continued innovation in pharmaceutical development and growing investments in scientific research worldwide. Competitive pressures are expected to intensify, driving innovation and efficiency improvements among market players.

L-Glutamic acid dimethyl ester hydrochloride (L-GADME HCl) is a specialty chemical with a relatively niche market, estimated at approximately $200 million globally in 2023. Concentration is highest in the pharmaceutical intermediate segment, accounting for roughly 60% of the market. Scientific research accounts for approximately 30%, while other applications make up the remaining 10%.

Concentration Areas:

Characteristics of Innovation:

Impact of Regulations:

Stringent regulatory requirements, particularly within the pharmaceutical sector, significantly influence manufacturing and quality control processes. Compliance costs are a substantial factor for manufacturers.

Product Substitutes:

Limited direct substitutes exist. However, alternative synthetic routes or other amino acid esters could be used depending on the specific application.

End-User Concentration:

Major end-users include pharmaceutical companies (large and small), research institutions, and specialized chemical distributors. High concentration is observed in regions with strong pharmaceutical and biotechnological industries.

Level of M&A:

The level of mergers and acquisitions (M&A) activity in this specific market segment is relatively low, with occasional strategic acquisitions driven by market consolidation or technology acquisition. It's estimated that approximately $10 million in M&A activity occurred in 2022-2023.

The L-GADME HCl market is projected to experience moderate growth over the next five years. Factors driving this growth include the increasing demand for peptide-based drugs and advanced materials, coupled with continued research and development efforts in biotechnology and pharmaceuticals. The global market is expected to reach an estimated $300 million by 2028, representing a compound annual growth rate (CAGR) of approximately 7%.

Technological advancements in the synthesis and purification of L-GADME HCl are leading to higher purity grades at lower costs. This makes the product more accessible to a wider range of research and development facilities and pharmaceutical manufacturers. Furthermore, the growing adoption of green chemistry principles is driving the development of more environmentally sustainable manufacturing processes.

The shift towards personalized medicine and the increased demand for targeted therapies are indirectly bolstering the demand for L-GADME HCl, as it plays a crucial role in the synthesis of various pharmaceutical compounds used in these therapies. Additionally, increased investment in research and development by both public and private entities is further fueling market growth. This includes initiatives focused on creating novel drug candidates and exploring new applications of L-GADME HCl in areas such as advanced materials and agricultural chemicals.

Competition remains relatively moderate, with a handful of major players and several smaller niche suppliers. However, the market is susceptible to pricing pressures, and manufacturers are constantly looking for ways to improve their efficiency and reduce costs. The increasing adoption of sophisticated analytical techniques for quality control is becoming crucial to ensuring product purity and meeting regulatory compliance. The overall outlook remains positive, with the market poised for continued expansion driven by innovation, increased demand, and investment in related sectors.

The pharmaceutical intermediate segment, specifically within the higher purity (≥99%) category, is projected to dominate the market, driven by stringent quality requirements from pharmaceutical companies. North America and Europe are expected to be the leading regions due to the presence of major pharmaceutical and biotechnology companies and well-established research infrastructure.

Dominant Segment: Pharmaceutical Intermediate (Purity ≥99%)

Dominant Regions:

Reasons for Dominance:

The high purity grade (≥99%) of L-GADME HCl is crucial for pharmaceutical applications to meet stringent quality standards and regulatory requirements. This contributes significantly to the dominance of this segment. Moreover, North America and Europe are home to many established pharmaceutical companies and research institutions, fostering a greater demand for high-quality specialty chemicals such as L-GADME HCl for research and development as well as drug manufacturing. The extensive regulatory frameworks in these regions also play a critical role in shaping the demand and supply dynamics of this market. The strong presence of multinational pharmaceutical companies further enhances the market share held by these regions.

This report provides a comprehensive analysis of the L-Glutamic Acid Dimethyl Ester Hydrochloride market, including market size, growth projections, regional segmentation, key players, and future trends. The report will deliver actionable insights into the market dynamics, competitive landscape, and growth opportunities. Key deliverables include market sizing and forecasting, detailed segmentation analysis by application, region, and purity, competitive profiling of key players, and analysis of industry trends and drivers.

The global L-GADME HCl market is valued at approximately $200 million in 2023. The market is segmented by application (pharmaceutical intermediates, scientific research, others), by purity (≥98%, ≥99%), and by geography. The pharmaceutical intermediate segment holds the largest market share, estimated at around 60%, driven by the growing demand for peptide drugs. The higher purity (≥99%) segment also commands a significant share, approximately 70% of the overall market, due to stringent pharmaceutical quality standards.

Market growth is projected to be driven by factors such as increasing demand for peptide-based drugs and advanced materials, coupled with continued research and development efforts in biotechnology and pharmaceuticals. The market is expected to reach approximately $300 million by 2028, demonstrating a robust CAGR of approximately 7%. This growth is expected to be relatively evenly distributed across various regions, although North America and Europe are likely to retain a larger share due to a higher concentration of pharmaceutical and biotech companies.

Market share is concentrated among a few key players, although several smaller niche suppliers also exist. Competitive dynamics are influenced by factors such as pricing, product quality, and innovation capabilities. Manufacturers are continuously seeking ways to enhance their efficiency and reduce production costs through technological advancements and process optimization. Price competition, while present, is somewhat tempered by the need for high-quality products and stringent regulatory compliance within the pharmaceutical sector.

The growth of the L-GADME HCl market is primarily driven by the burgeoning pharmaceutical industry, particularly the increasing demand for peptide-based drugs. Advances in biotechnology and research also contribute significantly, requiring this chemical for various applications. Furthermore, the development of new applications in areas such as agrochemicals and materials science is further bolstering the market.

Challenges include the relatively high cost of production, stringent regulatory requirements, and the potential for price competition from alternative chemical suppliers. Maintaining consistent high-purity levels and efficient manufacturing processes are also ongoing challenges.

Emerging trends include a focus on sustainable and environmentally friendly manufacturing processes, the development of higher-purity grades, and exploration of new applications in niche areas. The adoption of advanced analytical techniques for quality control is also an emerging trend.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Capot Chemical, Green Stone Swiss, Nuona Technology.

The market segments include Application, Types.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "L-Glutamic Acid Dimethyl Ester Hydrochloride," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the L-Glutamic Acid Dimethyl Ester Hydrochloride, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

See the similar reports

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.