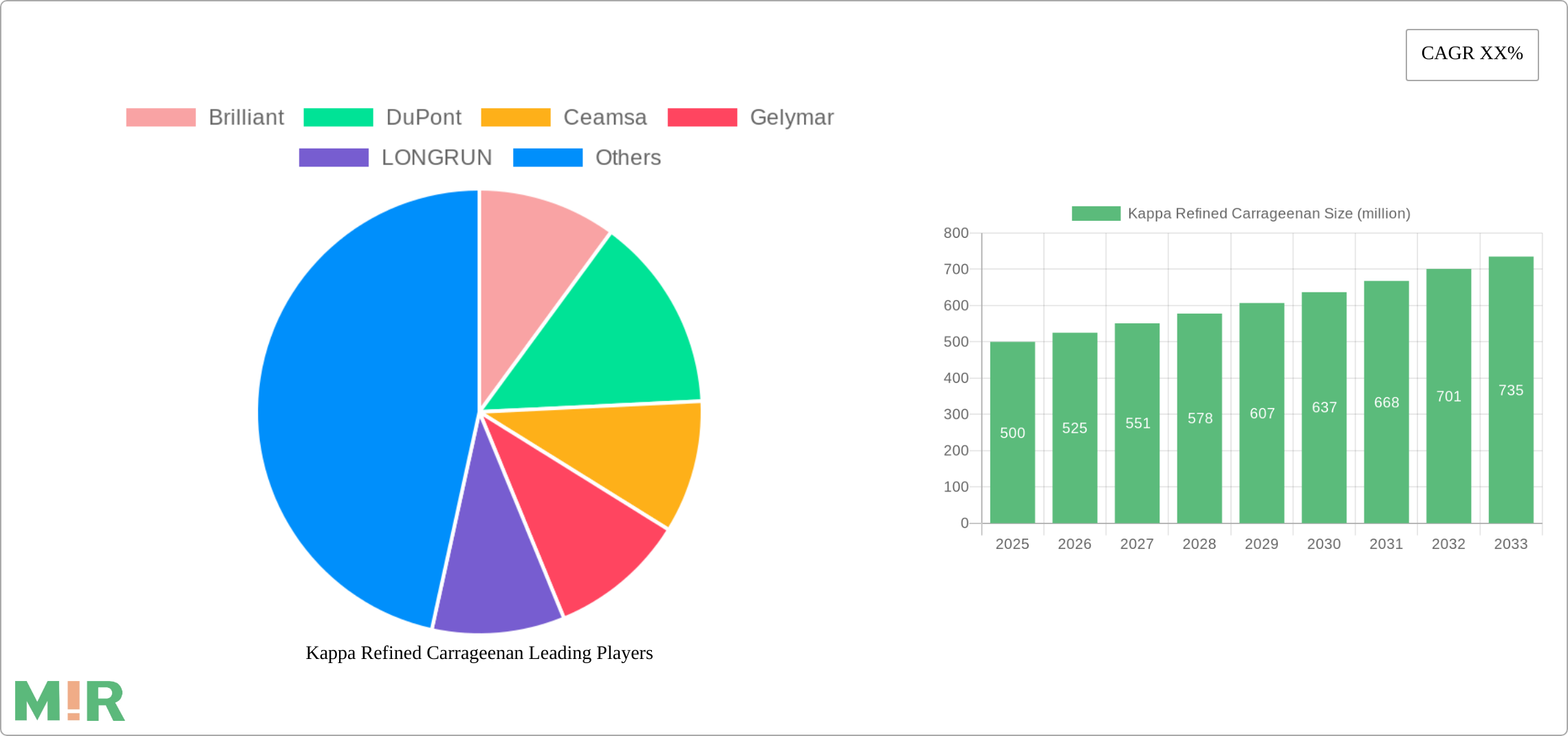

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kappa Refined Carrageenan?

The projected CAGR is approximately XX%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Kappa Refined Carrageenan by Application (Food, Medical, Daily Chemicals, Others), by Types (Food Grade, Pharmaceutical Grade, Others), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

The global Kappa Refined Carrageenan market exhibits robust growth, driven by increasing demand across diverse sectors. The food industry, a major consumer, utilizes Kappa Refined Carrageenan as a thickening, stabilizing, and gelling agent in dairy products, desserts, and processed foods. Growth in these sectors, coupled with rising consumer preference for convenient and shelf-stable food products, significantly fuels market expansion. Furthermore, the pharmaceutical and medical industries utilize Kappa Refined Carrageenan for its thickening and stabilizing properties in various formulations, contributing to market growth. The market is segmented by application (food, medical, daily chemicals, others) and type (food grade, pharmaceutical grade, others), reflecting the diverse applications of this versatile hydrocolloid. While precise market sizing data is unavailable, considering a typical CAGR of 5-7% within the hydrocolloids market and a conservative estimate for Kappa Refined Carrageenan's market share, we can reasonably project a 2025 market size of approximately $500 million. This assumes a slightly lower growth rate given that the market is already established. This figure is projected to grow steadily over the forecast period (2025-2033).

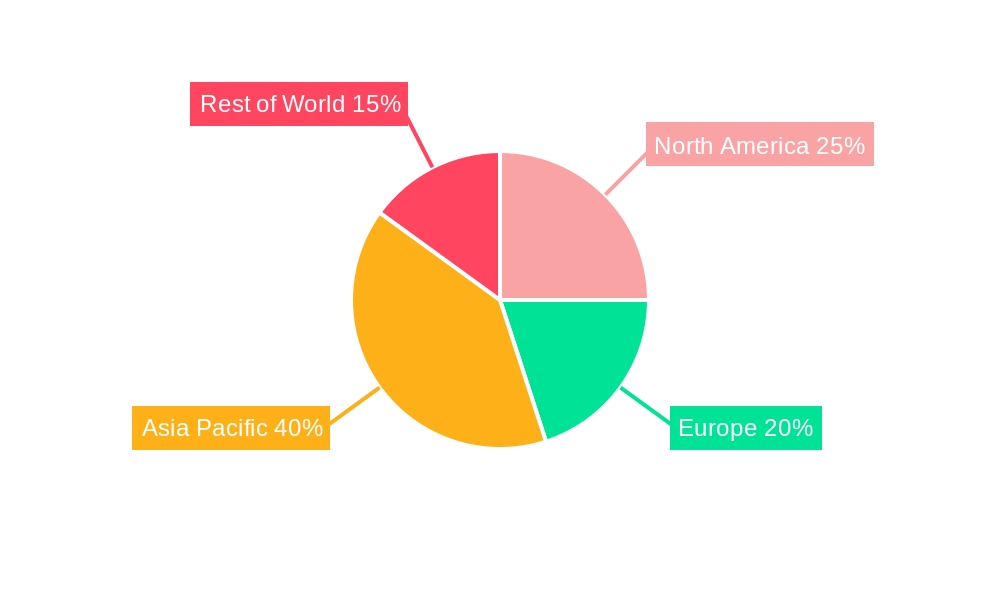

Geographical distribution reveals significant market presence across North America, Europe, and Asia Pacific. The Asia-Pacific region, driven by strong growth in food processing and pharmaceutical industries in countries like China and India, is anticipated to show above-average growth. While regulatory hurdles and the emergence of alternative thickening agents could present challenges, the overall market outlook for Kappa Refined Carrageenan remains positive, propelled by sustained growth across key application segments and regions. The competitive landscape includes both established multinational corporations and regional players, contributing to innovation and diverse product offerings. The forecast period suggests continued market expansion, fuelled by increasing demand for functional ingredients in processed foods and expanding applications in specialized industries.

The global Kappa Refined Carrageenan market is a multi-billion dollar industry, with an estimated size exceeding $2.5 billion in 2023. Key players such as CP Kelco, Cargill, and DuPont hold significant market share, each generating hundreds of millions of dollars in annual revenue from Kappa Refined Carrageenan sales. Smaller players contribute to the overall market volume, creating a diverse landscape.

Concentration Areas:

Characteristics of Innovation:

Impact of Regulations:

Stringent food safety regulations influence product purity and labeling requirements, driving innovation in quality control and transparency within the supply chain.

Product Substitutes:

Agar-agar, alginate, and other hydrocolloids act as substitutes, yet Kappa Refined Carrageenan maintains a competitive edge due to its unique properties.

End-User Concentration:

Large multinational food and pharmaceutical companies dominate the end-user market, negotiating significant purchasing volumes.

Level of M&A:

Consolidation is observed, with larger companies acquiring smaller ones to expand market share and product portfolio; however, the level of M&A activity is moderate.

The Kappa Refined Carrageenan market displays robust growth, driven by increasing demand from diverse sectors. The food industry's expansion, particularly in processed foods and beverages, significantly boosts carrageenan consumption. The pharmaceutical sector’s expanding use of carrageenan as a binder and stabilizer is also fueling growth. The rising global population and changing dietary habits contribute to the market's expansion, along with increasing consumer awareness of food safety and product quality. Health and wellness trends are also influencing demand, as consumers seek functional foods and pharmaceuticals with enhanced benefits. Technological advancements in carrageenan production and modification techniques are further driving innovation, leading to the development of novel products with improved functionality and cost-effectiveness. This results in increased efficiency and output in manufacturing. Furthermore, the rising demand for clean-label products is driving manufacturers to develop carrageenan with enhanced purity and sustainability attributes, contributing to market growth. Emerging markets in Asia and South America also represent key growth opportunities, given the region's expanding food and beverage industry. Lastly, the focus on sustainable sourcing and environmentally conscious production methods increases the appeal of Kappa Refined Carrageenan among ethically aware consumers. This has spurred the development of certifications and sustainable sourcing practices, further strengthening its position in the market.

The food application segment is projected to dominate the Kappa Refined Carrageenan market, representing over 60% of total consumption. Within this segment, Asia Pacific is expected to exhibit the strongest growth, driven primarily by robust expansion in the food processing industry of countries such as China and India.

The dominance of the food segment is anchored by its vast applications across various food types. The substantial growth anticipated in the Asia-Pacific region is fuelled by rising food consumption, rapid urbanization, and increased adoption of processed foods. This trend is further supported by the expanding middle class and growing demand for convenient and ready-to-eat meals. The food grade carrageenan segment remains the cornerstone of the market, and the combined impact of these factors assures its sustained leading role in the foreseeable future.

This report provides a comprehensive analysis of the Kappa Refined Carrageenan market, encompassing market size estimations, segmentation by application and type, regional breakdowns, competitor analysis, and key trends shaping the industry. It offers a detailed understanding of the market dynamics, including growth drivers, challenges, and future opportunities. Deliverables include detailed market sizing, detailed regional and segmental analysis, competitive landscape overview, and future projections.

The global Kappa Refined Carrageenan market is estimated at $2.5 billion in 2023, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5% during the forecast period (2023-2028). Market share is concentrated among a few large players, with CP Kelco, Cargill, and DuPont leading the industry. However, the presence of several smaller regional players contributes to the market's competitive dynamics. The high growth rate is fueled by factors such as increased demand from food and pharmaceutical sectors, and innovation in product development and applications. The market's future growth trajectory is projected to remain positive, driven by rising global population, changing dietary habits, and an expanding middle class in developing economies. Nevertheless, challenges such as fluctuating raw material prices and regulatory compliance pose potential limitations. Therefore, continued research and development, strategic partnerships, and efficient supply chain management are essential for sustaining market growth.

The Kappa Refined Carrageenan market is propelled by several key factors. The growing demand for processed foods and beverages is a major driver, as Kappa Refined Carrageenan is a crucial ingredient in various food products. The expansion of the pharmaceutical industry, particularly in the development of new drug formulations, further fuels market growth. Technological advancements that enhance Kappa Refined Carrageenan's functionality and production efficiency also contribute significantly. Furthermore, increased consumer awareness of food safety and the demand for natural and clean-label ingredients bolster market demand.

The Kappa Refined Carrageenan market faces challenges such as price volatility in raw materials, stringent regulatory compliance requirements, and the potential for the emergence of substitute products. Concerns regarding the potential health effects of carrageenan, though scientifically debated, can also impact consumer perception and market demand. Competition from other hydrocolloids further complicates market dynamics.

Emerging trends point towards a growing demand for sustainable and ethically sourced Kappa Refined Carrageenan. Innovation focuses on improving its functional properties for specific applications, and there’s a rising interest in developing novel products with enhanced health benefits. The market also sees increased emphasis on transparency and traceability throughout the supply chain.

(Note: Company website links provided where readily available. Not all companies have readily accessible global websites.)

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Brilliant, DuPont, Ceamsa, Gelymar, LONGRUN, Karagen Indonesia, CP Kelco, Lauta, W Hydrocolloids, Cargill, TBK, Zhenpai Hydrocolloids, Greenfresh, Fujian Global Ocean Biotechnology, Qingdao Gather Great Ocean.

The market segments include Application, Types.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Kappa Refined Carrageenan," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Kappa Refined Carrageenan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

See the similar reports

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.