1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Grade Tert-Butylhydroquinone?

The projected CAGR is approximately XX%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Food Grade Tert-Butylhydroquinone by Application (Beverage Ingredients, Food Preservatives, Personal Care Ingredients), by Types (99% Purity, Above 99% Purity), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

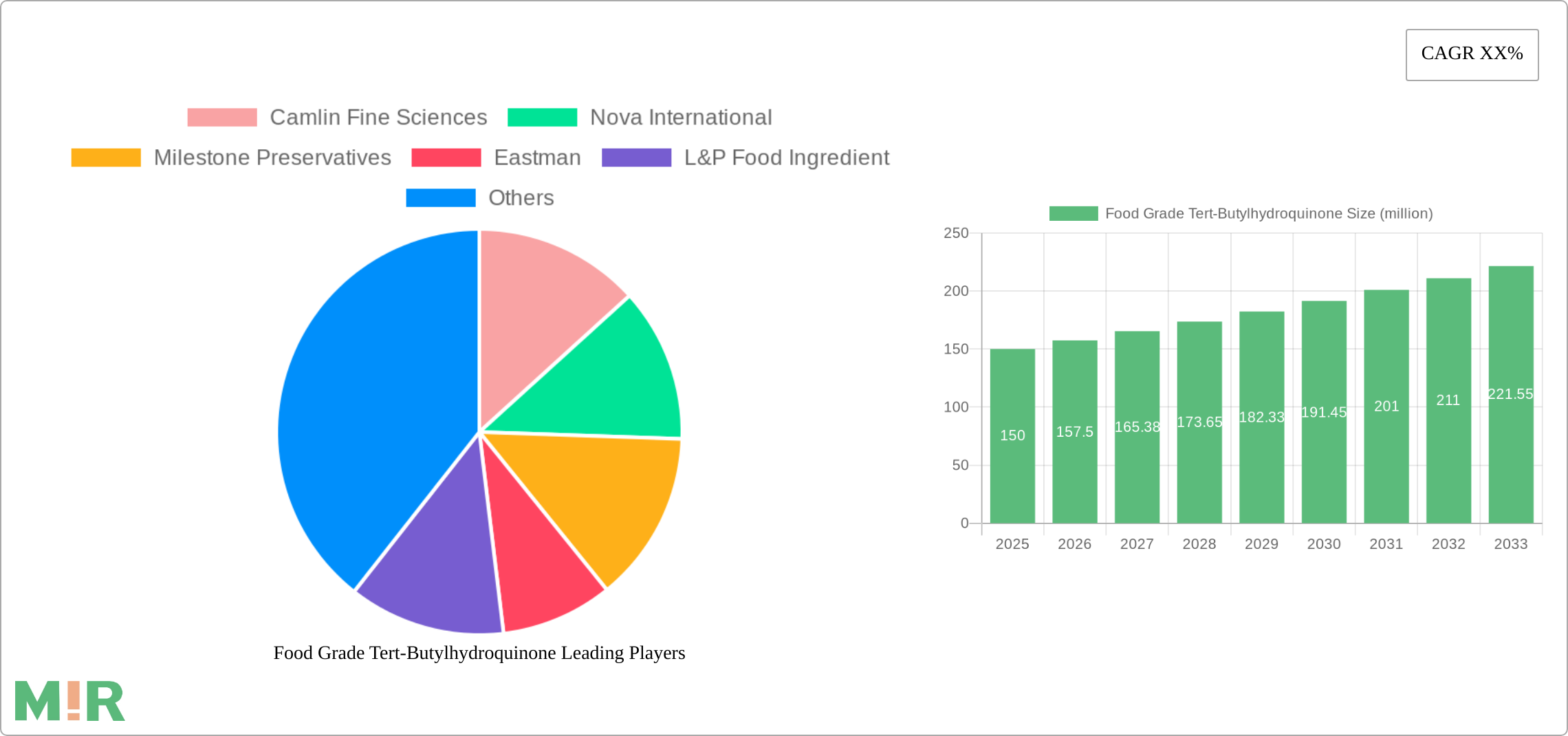

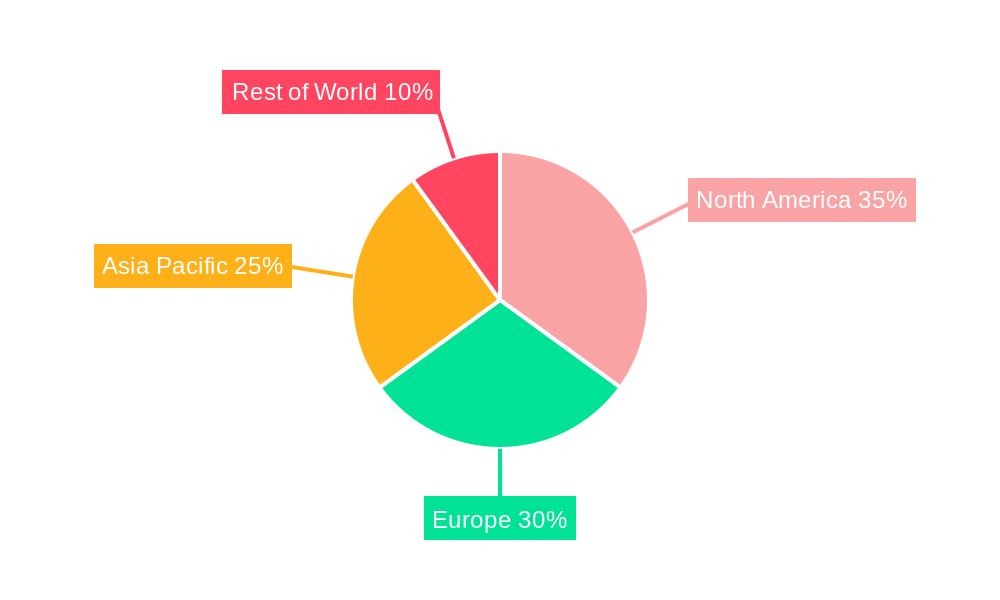

The global food grade tert-butylhydroquinone (TBHQ) market is experiencing robust growth, driven by its increasing adoption as a versatile food preservative and antioxidant in various food and beverage applications. The market, estimated at $150 million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5% from 2025 to 2033, reaching approximately $230 million by 2033. This growth is fueled by several factors. The rising demand for processed and packaged foods, particularly in developing economies, necessitates effective preservatives to extend shelf life and maintain product quality. TBHQ's exceptional antioxidant properties effectively combat lipid oxidation, preventing rancidity in fatty foods and enhancing their overall stability. Furthermore, its broad regulatory approval in many countries contributes to its widespread use across diverse food categories, including beverages, oils, and snacks. The market segmentation reveals a strong preference for higher purity grades (above 99%), reflecting the industry's focus on food safety and quality standards. Significant regional variations exist, with North America and Europe currently holding larger market shares due to established food processing industries and stringent food safety regulations. However, Asia-Pacific is expected to witness significant growth in the forecast period due to increasing food production and consumption in emerging economies like India and China.

Despite its advantages, the TBHQ market faces certain restraints. Concerns surrounding its potential health effects, albeit scientifically debated, continue to influence consumer perception and regulatory scrutiny in some regions. Moreover, the emergence of alternative preservatives and antioxidants may pose a challenge to TBHQ's market share in the long term. However, ongoing research into TBHQ's safety and efficacy, coupled with its cost-effectiveness compared to some alternatives, is likely to sustain its position as a vital food-grade preservative. Major players in the market, such as Camlin Fine Sciences, Eastman, and Nova International, are actively engaged in research and development, expanding their product portfolios, and focusing on geographic expansion to meet the rising global demand for TBHQ. The market's future trajectory will depend on balancing the benefits of TBHQ with addressing potential concerns regarding its safety and sustainability.

The global market for food-grade tert-butylhydroquinone (TBHQ) is estimated at $450 million in 2024, projected to reach $600 million by 2029, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 6%. This growth is driven by increasing demand in the food preservation and beverage industries.

Concentration Areas:

Characteristics of Innovation:

Impact of Regulations:

Stringent regulations concerning food additives and their permissible levels in various countries directly influence market dynamics. Compliance costs and variations in regulations across geographies present challenges for manufacturers.

Product Substitutes:

Other antioxidants like BHA, BHT, and tocopherols compete with TBHQ, although TBHQ's efficacy at lower concentrations provides a competitive edge.

End-User Concentration:

Large-scale food and beverage manufacturers dominate the end-user landscape, making up approximately 70% of the market. Smaller-scale manufacturers and personal care companies comprise the remaining 30%.

Level of M&A:

The level of mergers and acquisitions (M&A) activity within the TBHQ market remains moderate, with occasional strategic acquisitions of smaller specialty chemical companies by larger players aiming to expand their product portfolios.

The food-grade TBHQ market is experiencing several significant trends:

The rising global demand for processed and packaged foods is a primary driver. Consumers are increasingly reliant on convenient food options with extended shelf lives, fueling the demand for effective preservatives like TBHQ. Simultaneously, the increasing awareness of food safety and quality is leading to stricter regulatory scrutiny and a growing preference for products with clearly labeled and safe preservatives. This necessitates manufacturers to invest in transparent labeling and high-quality TBHQ to meet consumer expectations.

Furthermore, the growing popularity of ready-to-drink beverages, particularly in emerging economies, is significantly contributing to the market expansion. The need to maintain the quality and freshness of these beverages during storage and transportation further boosts the demand for TBHQ. The market also witnesses a shift towards more sustainable practices. Manufacturers are increasingly focusing on eco-friendly packaging and sourcing sustainable ingredients, creating opportunities for bio-based TBHQ and other environmentally conscious production methods. Simultaneously, the continuous research and development in antioxidant technology are leading to innovative formulations of TBHQ with enhanced efficacy, improved stability, and reduced potential drawbacks. This includes exploring nanoencapsulation techniques to control the release of TBHQ and optimizing its interaction with food matrices.

Another notable trend is the regional disparity in market growth. Developing economies are experiencing faster growth due to rising disposable incomes and changing lifestyles, increasing consumption of processed foods and beverages. This provides significant opportunities for TBHQ manufacturers to penetrate these markets. However, differing regulatory landscapes and consumer preferences in various regions pose challenges. Manufacturers must adapt their strategies to comply with local regulations and cater to specific consumer needs. Overall, the market displays a dynamic interplay of demand-side factors like consumer preferences, regulatory constraints, and supply-side factors like innovation and sustainability.

The Food Preservatives segment is projected to dominate the food-grade TBHQ market. This segment's dominance is underpinned by TBHQ's strong antioxidant properties, which effectively prevent lipid oxidation and rancidity in various food products.

Pointers:

This report provides a comprehensive analysis of the food-grade TBHQ market, encompassing market size and growth projections, key players, regional trends, and future growth opportunities. It examines various segments including application (beverages, food preservatives, personal care), purity levels, and regional markets. The report also includes an in-depth analysis of market dynamics, competitive landscapes, and regulatory factors influencing market growth. The deliverables include market sizing, segmentation analysis, competitive landscape assessment, growth drivers and challenges analysis, and regional market insights.

The global food-grade TBHQ market size was valued at approximately $380 million in 2023. The market is experiencing substantial growth, driven primarily by increasing demand from the food and beverage industries. Market projections indicate steady expansion, with a CAGR of approximately 6% projected to reach approximately $600 million by 2029. This growth is fuelled by the rising consumption of processed foods and beverages, especially in developing economies.

Market share is concentrated among several key players, including Camlin Fine Sciences, Eastman, and Nova International, who collectively hold a significant portion of the market. However, the market also includes numerous smaller manufacturers, particularly in regions like Asia. Competitive intensity remains moderate, with competition primarily focusing on price, quality, and innovation in product offerings.

Growth is driven by increasing demand from various sectors, such as processed foods (oils, fats, snacks), beverages, and some personal care products. However, growth is tempered by potential regulatory hurdles related to food additives and increasing consumer awareness of potentially harmful ingredients. The market displays regional variations in growth rates, with developing economies exhibiting faster growth rates compared to more mature markets.

The key drivers are the increasing demand for processed foods, the rising consumption of ready-to-drink beverages, and the need for effective and safe preservatives to extend the shelf life of food products. Furthermore, technological advancements in TBHQ production and formulation, leading to higher purity and improved efficacy, also contribute significantly.

Challenges include stringent regulations regarding food additives, potential health concerns surrounding the use of TBHQ, and the presence of substitute antioxidants in the market. Fluctuations in raw material prices and competition from other preservatives also pose challenges for manufacturers.

Emerging trends include the growing focus on sustainable and environmentally friendly production methods, the increasing demand for higher-purity TBHQ, and the exploration of nanoencapsulation technologies to improve its efficacy and stability. The development of bio-based TBHQ also represents a significant emerging trend.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include Camlin Fine Sciences, Nova International, Milestone Preservatives, Eastman, L&P Food Ingredient, Yasho Industries, Fengyang Chemical, Crystal Quinone.

The market segments include Application, Types.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Food Grade Tert-Butylhydroquinone," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Food Grade Tert-Butylhydroquinone, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.