1. What is the projected Compound Annual Growth Rate (CAGR) of the Chemically Amplified Photoresists?

The projected CAGR is approximately XX%.

Market

Insights

Reports delivered globally, covering a wide range of industries and sectors.

Clients who trust our expertise and rely on our insights for business decisions.

Managed Reports, ensuring seamless updates and premium service.

Satisfied Customers, committed to delivering exceptional value and quality.

Chemically Amplified Photoresists by Application (Foundry, IDM), by Types (Positive Photoresist, Negative Photoresist), by North America (United States, Canada, Mexico), by South America (Brazil, Argentina, Rest of South America), by Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe), by Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa), by Asia Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Forecast 2025-2033

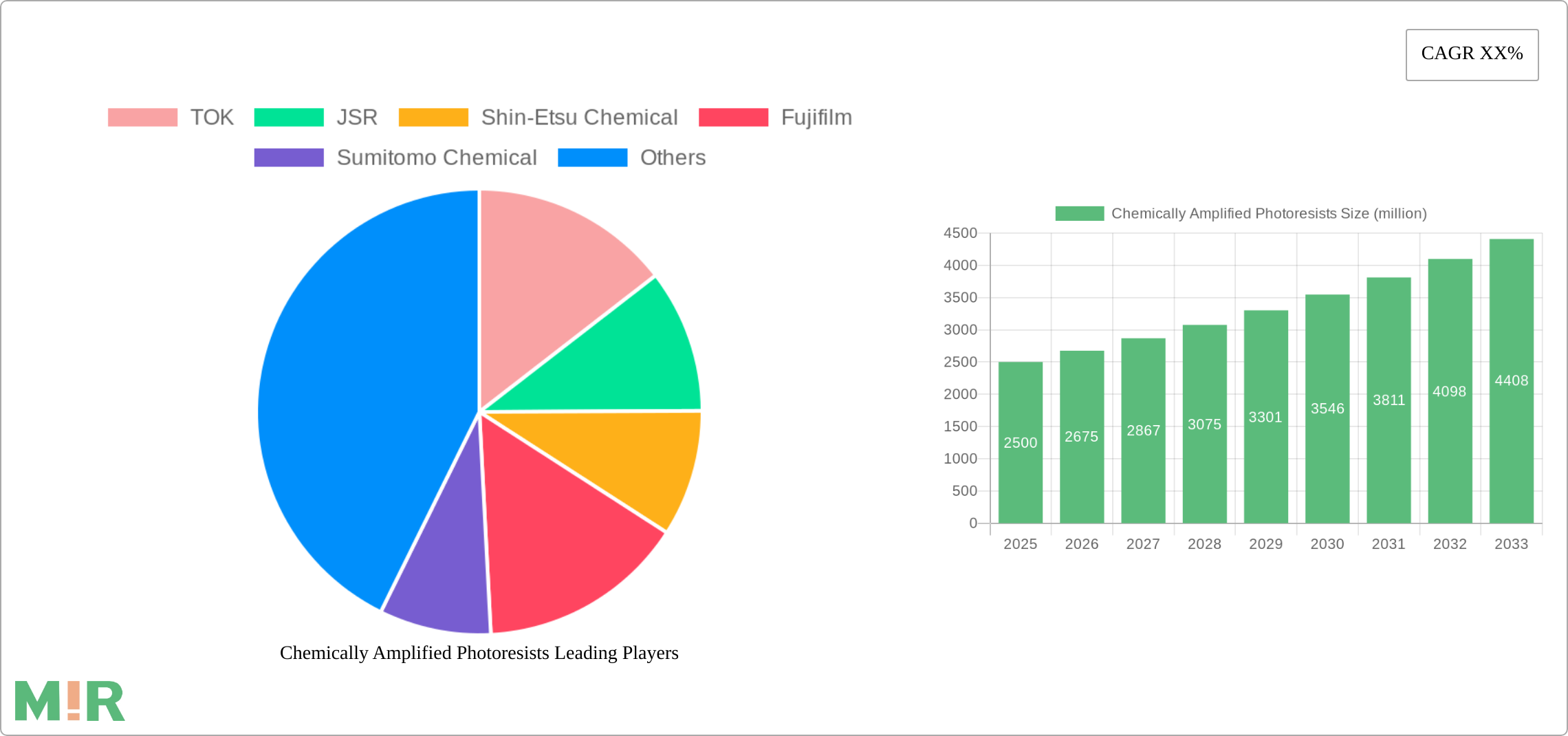

The chemically amplified photoresist (CAP) market is experiencing robust growth, driven by the increasing demand for advanced semiconductor devices with finer feature sizes. The market, estimated at $2.5 billion in 2025, is projected to expand at a compound annual growth rate (CAGR) of 7% from 2025 to 2033, reaching approximately $4.5 billion by 2033. This growth is fueled by several key factors. Firstly, the ongoing miniaturization of integrated circuits (ICs) in electronics necessitates the use of high-resolution photoresists like CAPs for precise patterning. Secondly, the expanding adoption of advanced semiconductor manufacturing processes like extreme ultraviolet (EUV) lithography further boosts the demand for CAPs tailored for these sophisticated techniques. Technological advancements in CAP formulations, such as improved sensitivity and resolution, are also contributing to the market's expansion. Finally, the burgeoning demand for electronics across various applications, including smartphones, computers, and automotive electronics, creates an underlying market pull for advanced materials like CAPs.

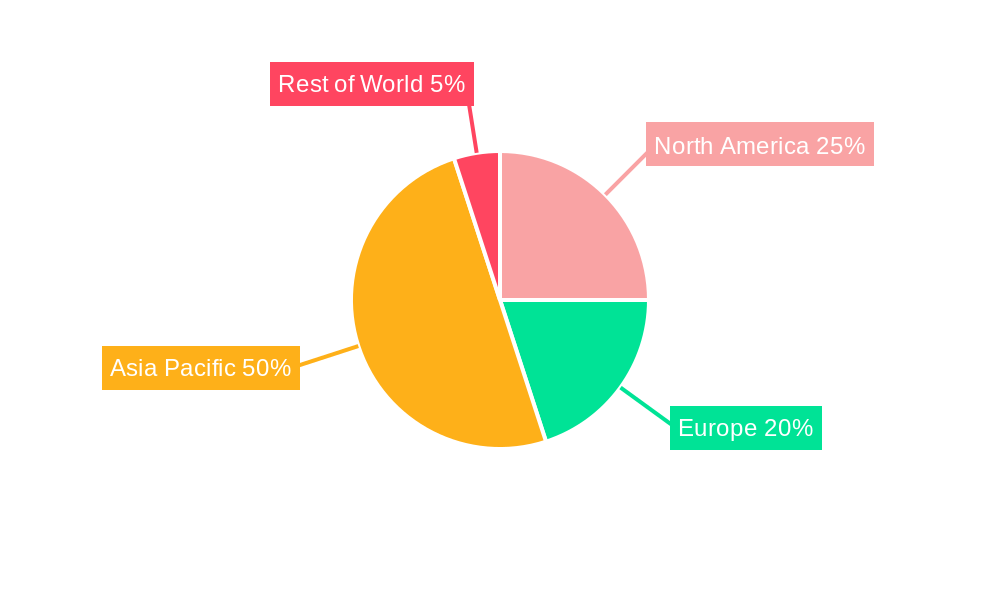

The market segmentation reveals strong performance across both application and type. Foundries and integrated device manufacturers (IDMs) are the primary consumers of CAPs, with foundries showing slightly faster growth due to their volume production. Within types, positive photoresists hold a larger market share than negative photoresists, primarily due to their superior resolution capabilities and ease of processing. Geographically, Asia Pacific, particularly China, South Korea, and Japan, dominates the CAP market due to the concentration of semiconductor manufacturing facilities. However, North America and Europe remain significant regions, driven by research and development efforts and substantial semiconductor industries. While the market faces certain restraints such as stringent regulatory compliance and material cost fluctuations, the long-term outlook remains positive, with continued investment in research and development and advancements in lithography techniques expected to sustain market expansion throughout the forecast period.

The chemically amplified photoresist (CAP) market is a multi-billion dollar industry, with global sales exceeding $3 billion annually. Key players, including TOK, JSR, Shin-Etsu Chemical, Fujifilm, Sumitomo Chemical, Dongjin Semichem, and DuPont, dominate the landscape, collectively controlling an estimated 85% of the market share. This high concentration is due to significant barriers to entry, including substantial R&D investment and stringent quality control requirements.

Concentration Areas:

Characteristics of Innovation:

Impact of Regulations:

Environmental regulations regarding volatile organic compounds (VOCs) are driving the development of more environmentally friendly CAP formulations.

Product Substitutes:

While no complete substitutes exist, alternative lithographic techniques are constantly being explored, such as directed self-assembly and nanoimprint lithography. However, these technologies face significant challenges in terms of cost-effectiveness and scalability.

End User Concentration:

The market is heavily concentrated among a few major semiconductor manufacturers, like Samsung, TSMC, Intel, and SK Hynix, representing a significant portion of total demand.

Level of M&A:

The level of mergers and acquisitions (M&A) activity in the CAP market is moderate. Strategic partnerships and technology licensing agreements are more common than outright acquisitions.

The chemically amplified photoresist market is characterized by several key trends. Firstly, the relentless drive towards miniaturization in semiconductor manufacturing is fueling the demand for higher-resolution CAPs. This necessitates continuous innovation in materials science and formulation chemistry to achieve finer feature sizes and improved process control. The transition to EUV lithography presents both a significant challenge and a major opportunity for CAP manufacturers. While EUV poses unique material challenges, its adoption is driving the development of specialized CAPs optimized for this technology. The increasing complexity of semiconductor fabrication processes demands improved resist performance characteristics, including enhanced sensitivity, resolution, and line edge roughness control. This is leading to the development of multi-layer resist systems and advanced resist processing techniques. Furthermore, environmental concerns are prompting the industry to focus on more environmentally friendly CAP formulations with reduced VOC content. The industry is also witnessing a growing demand for high-throughput resist materials to increase production efficiency. Competition is fierce, with leading players continuously investing in R&D to maintain a competitive edge. This ongoing investment leads to the development of new materials and improved processing techniques. Moreover, the geographic distribution of semiconductor manufacturing facilities influences regional demand patterns. Growth in regions such as Southeast Asia is creating additional opportunities for CAP suppliers. Finally, collaboration and partnerships between material suppliers and semiconductor manufacturers are becoming increasingly important for optimizing resist performance and integrating it into advanced process flows. This collaborative approach accelerates innovation and ensures the timely development of materials that meet the stringent requirements of cutting-edge semiconductor technology.

The Foundry segment is poised to dominate the chemically amplified photoresist market. The relentless demand for advanced logic and memory chips, driven by the proliferation of mobile devices, high-performance computing, and artificial intelligence, directly translates into a burgeoning need for high-performance photoresists. Foundries, responsible for manufacturing chips on a large scale for various customers, represent the largest consumer base. The production of advanced node chips requires advanced materials capable of resolving incredibly small features, and CAPs are essential in this context.

Foundry Segment Dominance:

Regional Market Share:

The synergy between the foundry segment and the Asia-Pacific region ensures a sustained dominance for the foreseeable future. The high concentration of semiconductor fabrication facilities coupled with the ever-growing demand for advanced chips creates a potent driver for the growth of the CAP market in this specific segment and geographical area.

This report provides a comprehensive analysis of the chemically amplified photoresist market, encompassing market size and growth projections, competitive landscape analysis, regional market insights, and key technological trends. The report delivers detailed profiles of leading players, including their market share, product portfolios, and strategic initiatives. Furthermore, it identifies key drivers and restraints shaping market dynamics, offering invaluable insights for stakeholders across the value chain. The report also includes a detailed segmentation analysis based on application (foundry, IDM), type (positive, negative), and region.

The chemically amplified photoresist market is experiencing robust growth, driven primarily by the continuous advancements in semiconductor technology and the increasing demand for higher-resolution chips. The market size is projected to reach approximately $4 billion by 2028, exhibiting a compound annual growth rate (CAGR) exceeding 7%. This growth is largely attributed to the rising adoption of EUV lithography, necessitating the development of specialized CAPs. The major players in the market hold a significant market share, primarily due to high barriers to entry and substantial investments in R&D. Competition is intense, with companies focusing on innovation and strategic partnerships to maintain a competitive edge. The market structure is concentrated, with the leading players controlling a significant portion of the overall market share. The market segmentation by application and type further reveals variations in growth rates and market shares across different segments. The foundry segment demonstrates comparatively higher growth due to the large-scale chip production and demands for advanced materials. The positive photoresist type maintains a larger market share compared to negative photoresist due to its wider applicability and advantages in high-resolution lithography.

The primary drivers for the growth of the chemically amplified photoresist market are the continuous miniaturization of semiconductor devices, the increasing adoption of EUV lithography, and the growing demand for advanced electronic devices. This necessitates the development of high-resolution, high-sensitivity photoresist materials capable of meeting the stringent requirements of advanced semiconductor manufacturing processes. Further growth is fueled by increasing investments in R&D and the continuous improvement of existing CAP technologies.

The key challenges faced by the CAP market include the high cost of material development and manufacturing, stringent quality control requirements, and the emergence of competing lithographic technologies. Environmental regulations regarding VOC emissions also pose a significant challenge, driving the need for more environmentally friendly formulations. The high cost of EUV lithography equipment and the complexity of its integration into manufacturing processes also impact market growth.

Emerging trends include the development of novel CAP materials with improved performance characteristics, the use of advanced resist processing techniques, and the exploration of new lithographic technologies. The increasing focus on sustainability is also driving the development of more environmentally friendly CAP formulations. Furthermore, increasing collaborations between material suppliers and semiconductor manufacturers are leading to improved resist integration and optimization.

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Note* : In applicable scenarios

Primary Research

Secondary Research

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence

The projected CAGR is approximately XX%.

Key companies in the market include TOK, JSR, Shin-Etsu Chemical, Fujifilm, Sumitomo Chemical, Dongjin Semichem, DuPont.

The market segments include Application, Types.

The market size is estimated to be USD XXX million as of 2022.

N/A

N/A

N/A

N/A

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

The market size is provided in terms of value, measured in million and volume, measured in K.

Yes, the market keyword associated with the report is "Chemically Amplified Photoresists," which aids in identifying and referencing the specific market segment covered.

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

To stay informed about further developments, trends, and reports in the Chemically Amplified Photoresists, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Market Insights Reports offers comprehensive market research reports and analysis, giving businesses important information about their clients, rivals, and sector to help them make well-informed decisions on operations, marketing, and business strategy. We offer a variety of services in addition to market research, data analysis, and strategy planning. In order to find opportunities and learn more about our competitors and the industry at large, we employ competitive analysis. To identify areas for development, we also evaluate our performance against that of our rivals. We can determine the places at which we can offer our clients the most value by performing value chain analysis.

Additionally, clients receive a thorough overview of their industry business environment. We can find trends that help us forecast future possibilities and threats by examining global macroeconomic dynamics and consumer behavior patterns. By analyzing their features and advantages, contrasting them with comparable items on the market, and evaluating both their quantitative and qualitative performance, we comprehensively evaluate our clients' products. This allows us to assist customers in determining how their goods compare to those of their rivals and in creating successful marketing plans. Our group has been successful in gaining a thorough grasp of our clients' requirements and offering them creative solutions. We currently provide services to more than 50 nations in Europe, the Middle East, Africa, Latin America, Asia Pacific, and North America. Because of our global reach, we have been able to establish trusting bonds with our partners and clients in various nations, improving customer service and forging a more cohesive worldwide presence.

We use cookies to enhance your experience.

By clicking "Accept All", you consent to the use of all cookies.

Customize your preferences or read our Cookie Policy.